Home /

Expert Answers /

Accounting /

i-need-help-solving-for-years-2016-2020-the-management-of-oriole-instrument-company-had-concluded-w-pa840

(Solved): I need help solving for years 2016-2020 The management of Oriole Instrument Company had concluded, w ...

I need help solving for years 2016-2020

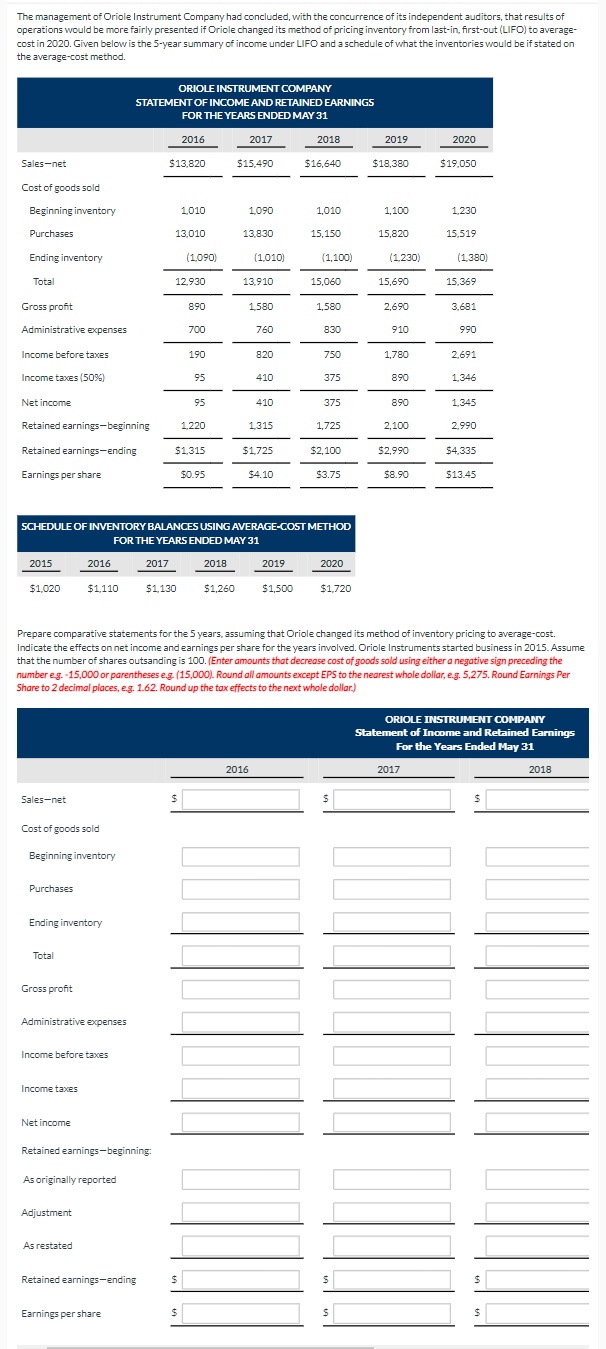

The management of Oriole Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Oriole changed its method of pricing inventory from last-in, first-out (LIFO) to averagecost in 2020. Given below is the 5-year summary of income under LIFO and a schedule of vihat the inventories would be if stated on the average-cost method. Prepare comparative statements for the 5 years, assuming that Oriole changed its method of inventory pricing to average-cost. Indicate the effects on net income and earnings per share for the years involved. Oriole Instruments started business in 2015 . Assume that the number of shares outsanding is 100. (Enter amounts that decrease cost of goods sold using either a negative sign preceding the number eg. -15,000 or parentheses eg. (15,000). Round all amounts except EPS to the nearest whole dollar, e.g. 5,275. Round Earnings Per Share to 2 decimal places, eg. 1.62. Round up the tax effects to the next whole dollar.)

Expert Answer

Answer:Preparation of the Comparative Statement for the 5 Years Assuming that Oriole changed its Method of Inventory Pricing to average cost.