Home /

Expert Answers /

Finance /

illustration-9-from-the-following-particulars-of-the-income-of-shri-gordhan-das-compute-t-pa405

(Solved): Illustration 9. From the following particulars of the income of Shri Gordhan Das, compute t ...

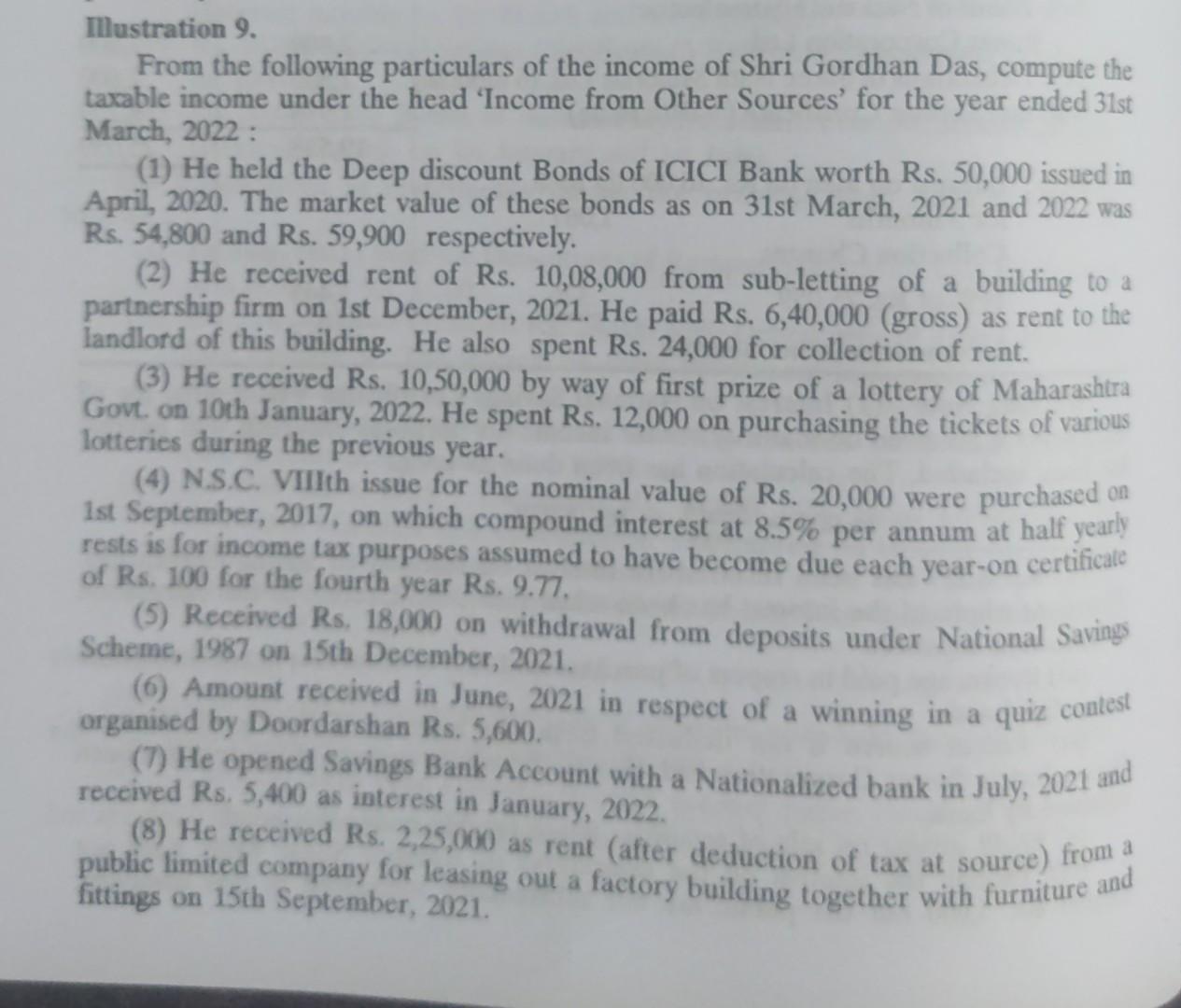

Illustration 9. From the following particulars of the income of Shri Gordhan Das, compute the taxable income under the head 'Income from Other Sources' for the year ended 31st March, 2022 : (1) He held the Deep discount Bonds of ICICI Bank worth Rs. 50,000 issued in April, 2020. The market value of these bonds as on 31st March, 2021 and 2022 was Rs. 54,800 and Rs. 59,900 respectively. (2) He received rent of Rs. from sub-letting of a building to a partnership firm on 1st December, 2021. He paid Rs. 6,40,000 (gross) as rent to the landlord of this building. He also spent Rs. 24,000 for collection of rent. (3) He received Rs. 10,50,000 by way of first prize of a lottery of Maharashtra Govt. on 10th January, 2022. He spent Rs. 12,000 on purchasing the tickets of various lotteries during the previous year. (4) N.S.C. VIIIth issue for the nominal value of Rs. 20,000 were purchased on 1st September, 2017, on which compound interest at per annum at half yearly rests is for income tax purposes assumed to have become due each year-on certificatc of Rs. 100 for the fourth year Rs. 9.77 . (5) Received Rs, 18,000 on withdrawal from deposits under National Savings Scheme, 1987 on 15th December, 2021. (6) Amount received in June, 2021 in respect of a winning in a quiz contest arganised by Doordarshan Rs. 5,600 . (7) He opened Savings Bank Account with a Nationalized bank in July, 2021 and received Rs. 5,400 as interest in January, 2022. (8) He received Rs. as rent (after deduction of tax at source) from a public limited company for leasing out a factory building together with furniture and fittings on 15th September, 2021 .

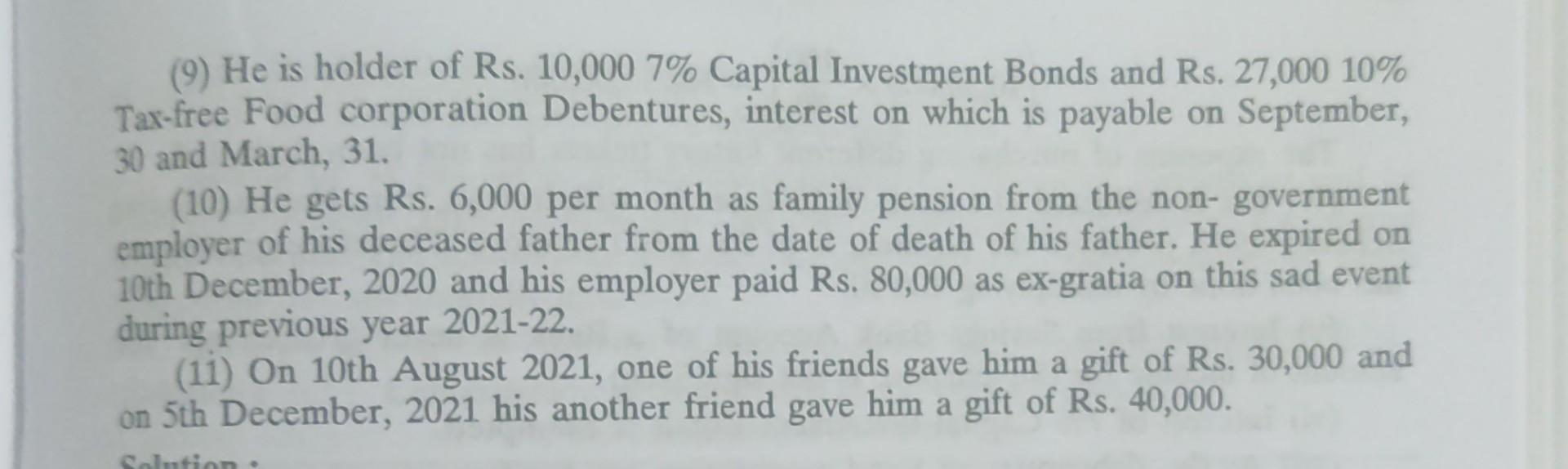

(9) He is holder of Rs. 10,000 7\% Capital Investment Bonds and Rs. Tax-free Food corporation Debentures, interest on which is payable on September, 30 and March, 31. (10) He gets Rs. 6,000 per month as family pension from the non- government employer of his deceased father from the date of death of his father. expired on 10th December, 2020 and his employer paid Rs. 80,000 as ex-gratia on this sad event during previous year 2021-22. (1i) On 10th August 2021, one of his friends gave him a gift of Rs. 30,000 and on 5th December, 2021 his another friend gave him a gift of Rs. 40,000 .