Home /

Expert Answers /

Other Math /

in-2022-henry-jones-social-security-number-123-45-6789-works-as-a-freelance-driver-finding-custo-pa183

(Solved): In 2022, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding custo ...

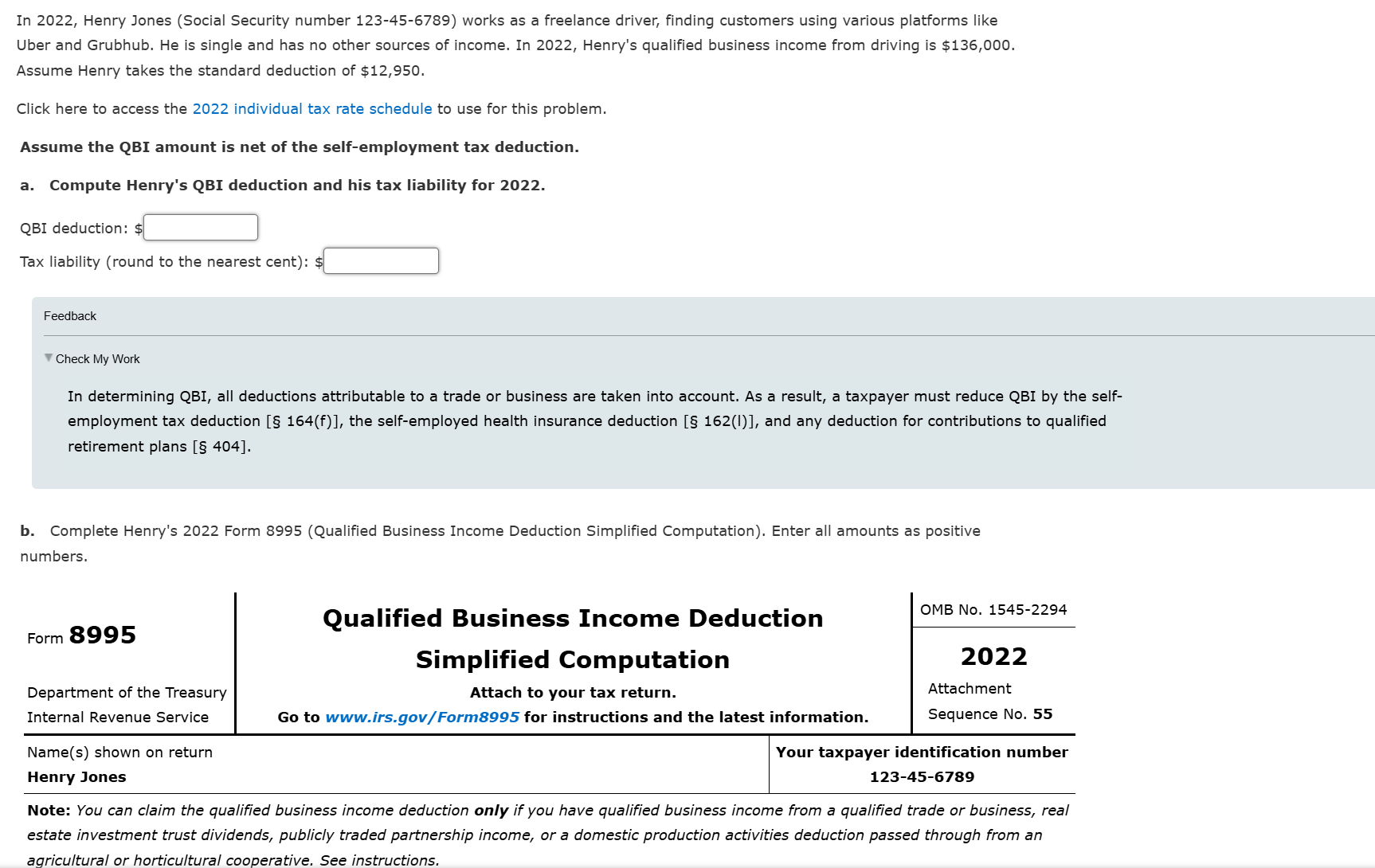

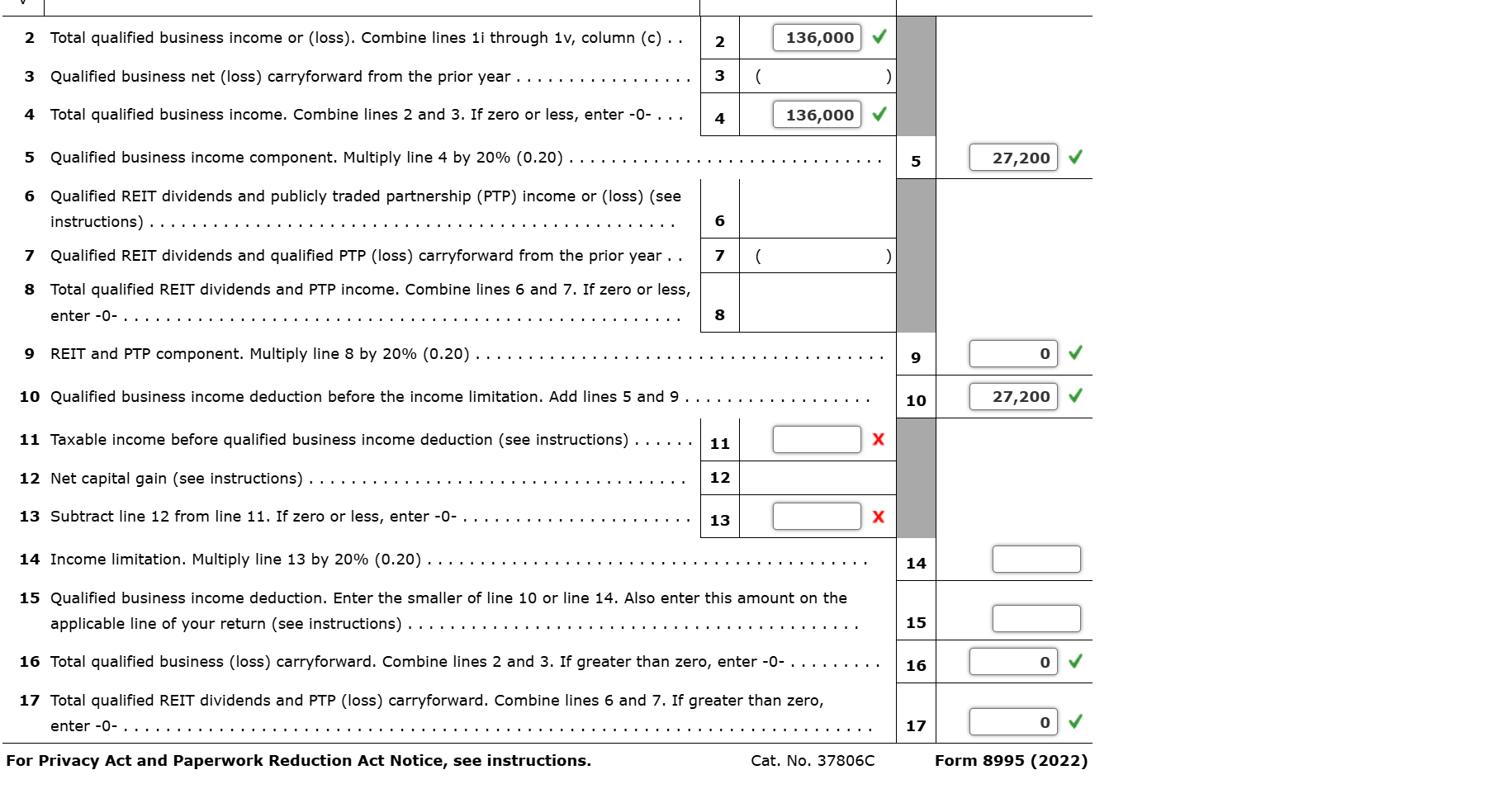

In 2022, Henry Jones (Social Security number 123-45-6789) works as a freelance driver, finding customers using various platforms like Uber and Grubhub. He is single and has no other sources of income. In 2022, Henry's qualified business income from driving is ()/(( ()/()$ 136,000 ()/()).) Assume Henry takes the standard deduction of ()/(( ()/()$ 12,950 ()/()).) Click here to access the 2022 individual tax rate schedule to use for this problem. Assume the QBI amount is net of the self-employment tax deduction. a. Compute Henry's QBI deduction and his tax liability for 2022. QBI deduction: ()/(( ()/()$ ()/())) Tax liability (round to the nearest cent): ()/(( ()/()$ ()/())) Feedback V Check My Work In determining QBI, all deductions attributable to a trade or business are taken into account. As a result, a taxpayer must reduce QBI by the selfemployment tax deduction [§ 164(f)], the self-employed health insurance deduction [§162(I)], and any deduction for contributions to qualified retirement plans [§ 404]. b. Complete Henry's 2022 Form 8995 (Qualified Business Income Deduction Simplified Computation). Enter all amounts as positive numbers. Note: You can claim the qualified business income deduction only if you have qualified business income from a qualified trade or business, real estate investment trust dividends, publicly traded partnership income, or a domestic production activities deduction passed through from an agricultural or horticultural cooperative. See instructions.