(Solved): In respect to the fifteen motorbikes leased to Xander Plc over three years: Xander Plc. must pay add ...

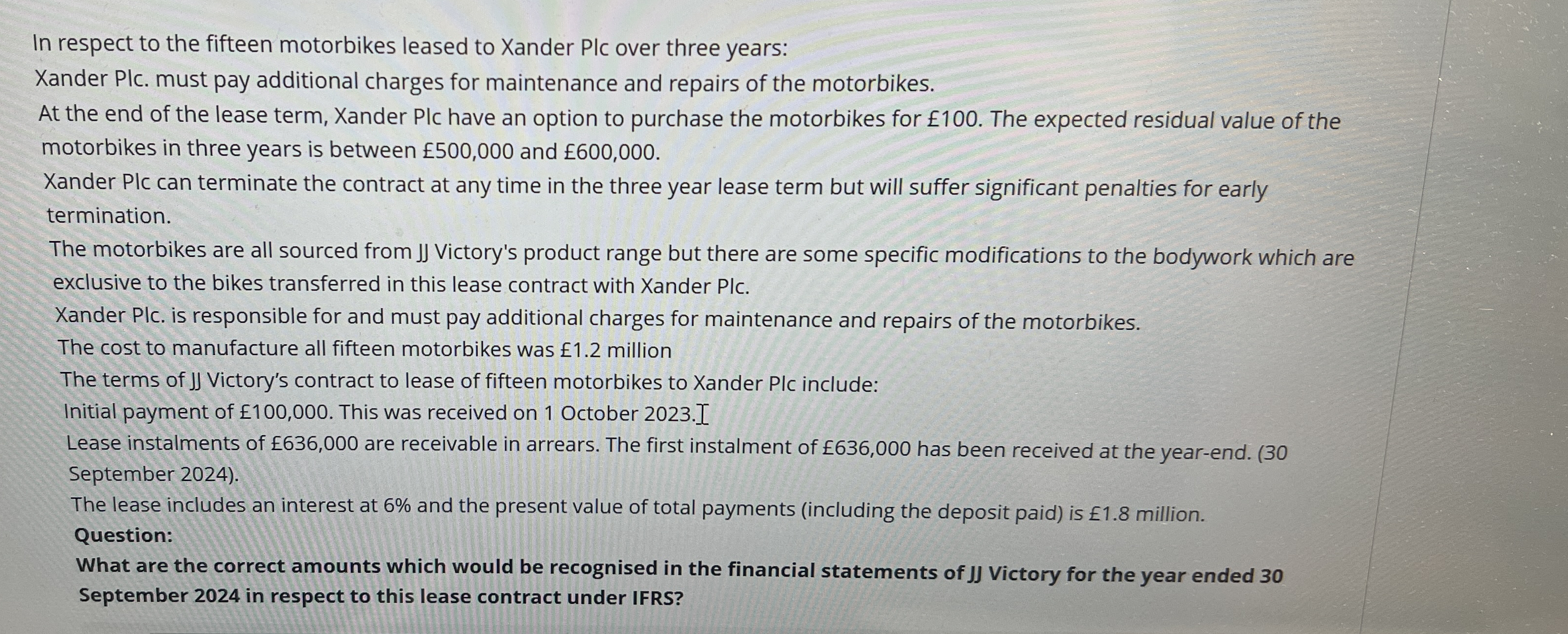

In respect to the fifteen motorbikes leased to Xander Plc over three years: Xander Plc. must pay additional charges for maintenance and repairs of the motorbikes. At the end of the lease term, Xander Plc have an option to purchase the motorbikes for

£100. The expected residual value of the motorbikes in three years is between

£500,000and

£600,000. Xander Plc can terminate the contract at any time in the three year lease term but will suffer significant penalties for early termination. The motorbikes are all sourced from JJ Victory's product range but there are some specific modifications to the bodywork which are exclusive to the bikes transferred in this lease contract with Xander PIc. Xander Plc. is responsible for and must pay additional charges for maintenance and repairs of the motorbikes. The cost to manufacture all fifteen motorbikes was

£1.2million The terms of JJ Victory's contract to lease of fifteen motorbikes to Xander Plc include: Initial payment of

£100,000. This was received on 1 October 2023.] Lease instalments of

£636,000are receivable in arrears. The first instalment of

£636,000has been received at the year-end. ( 30 September 2024). The lease includes an interest at

6%and the present value of total payments (including the deposit paid) is

£1.8million. Question: What are the correct amounts which would be recognised in the financial statements of JJVictory for the year ended 30 September 2024 in respect to this lease contract under IFRS?