Home /

Expert Answers /

Finance /

indications-develop-the-following-exercises-in-excel-responding-to-the-points-mentioned-below-de-pa131

(Solved): Indications: Develop the following exercises in Excel responding to the points mentioned below. De ...

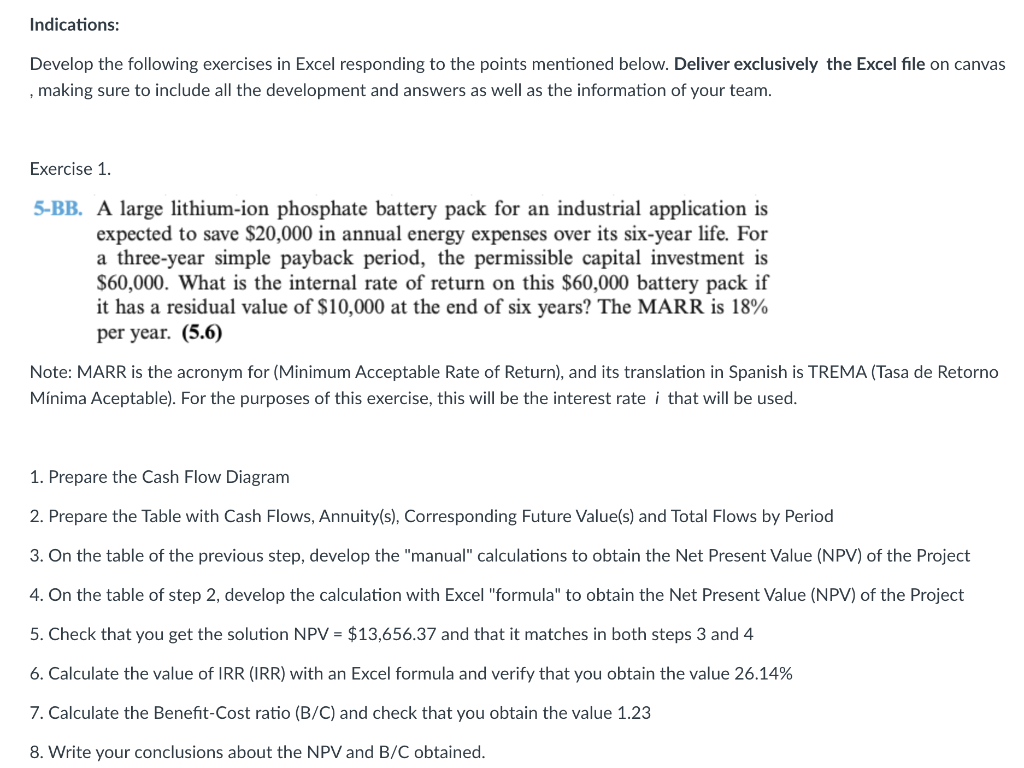

Indications: Develop the following exercises in Excel responding to the points mentioned below. Deliver exclusively the Excel file on canvas , making sure to include all the development and answers as well as the information of your team. Exercise 1. 5-BB. A large lithium-ion phosphate battery pack for an industrial application is expected to save in annual energy expenses over its six-year life. For a three-year simple payback period, the permissible capital investment is . What is the internal rate of return on this battery pack if it has a residual value of at the end of six years? The MARR is per year. (5.6) Note: MARR is the acronym for (Minimum Acceptable Rate of Return), and its translation in Spanish is TREMA (Tasa de Retorno Minima Aceptable). For the purposes of this exercise, this will be the interest rate that will be used. 1. Prepare the Cash Flow Diagram 2. Prepare the Table with Cash Flows, Annuity(s), Corresponding Future Value(s) and Total Flows by Period 3. On the table of the previous step, develop the "manual" calculations to obtain the Net Present Value (NPV) of the Project 4. On the table of step 2, develop the calculation with Excel "formula" to obtain the Net Present Value (NPV) of the Project 5. Check that you get the solution NPV and that it matches in both steps 3 and 4 6. Calculate the value of IRR (IRR) with an Excel formula and verify that you obtain the value 7. Calculate the Benefit-Cost ratio (B/C) and check that you obtain the value