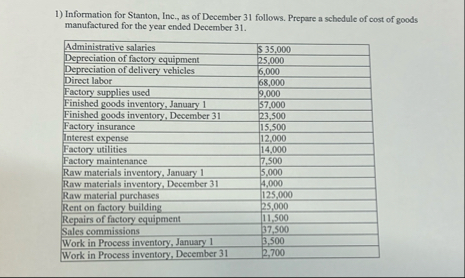

(Solved): Information for Stanton, Inc., as of December 31 follows. Prepare a schedule of cost of goods manufa ...

Information for Stanton, Inc., as of December 31 follows. Prepare a schedule of cost of goods manufactured for the year ended December 31. \table[[Administrative salaries,535,000],[Depreciation of factory equipment,25,000],[Depreciation of delivery vehicles,6,000],[Direct labor,68,000],[Factory supplies used,9,000],[Finished goods inventory, January 1,57,000],[Finished goods inventory, December 31,23,500],[Factory insurance,15,500],[Interest expense,12,000],[Factory utilities,14,000],[Factory maintenance,7,500],[Raw materials inventory, January I,5,000],[Raw materials inventory, December 31,4,000],[Raw material purchases,125,000],[Rent on factory building,25,000],[Repairs of factory equipment,11,500],[Sales commissions,37,500],[Work in Process inventory, January 1,3,500],[Work in Process inventory, December 31,2,700]]