Home /

Expert Answers /

Finance /

instrlctions-as-the-newly-appointed-cfo-of-an-established-firm-your-ceo-brings-you-a-proposal-to-a-pa128

(Solved): INSTRLCTIONS As the newly appointed CFO of an established firm, your CEO brings you a proposal to a ...

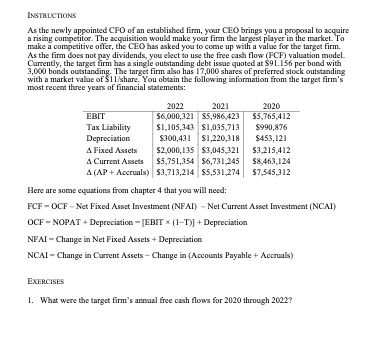

INSTRLCTIONS As the newly appointed CFO of an established firm, your CEO brings you a proposal to acquire a rising competitor. The acquisition would make your firm the largest player in the market. To make a competitive offer, the CEO has asked you to come up with a value for the target firm. As the firm does not pay dividends, you elect to use the free cash flow (FCF) valuation model. Currently, the target firm has a single outstanding debt issue quoted at per bond with 3,000 bonds outstanding. The target firm also has 17,000 shares of preferred stock outstanding with a market value of \$1 1/share. You obtain the following information from the target firm's most recent three years of financial statements: Here are some equations from chapter 4 that you will need: FCF OCF - Net Fixed Asset Investment (NFAI) - Net Current Asset Imvestment (NCAI) OCF = NOPAT + Depreciation - [FBIT Depreciation NFAI - Change in Net Fixed Assets + Depreciation

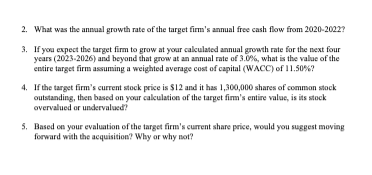

2. What was the annaal growth rate of the target firm's annual free cash flow from 2020-2022? 3. If you expect the target firm to grow at your calculated annual growth rate for the next four years and beyond that grow at an annual rate of , what is the value of the entire target firm assuming a weighted average cost of capital (WACC) of ? 4. If the target firm's current stock price is and it has shares of common stock outstanding, then based on your calculation of the tarpet firm's entire value, is its stock. overvalued or undervalued? 5. Based on your evaluation of the target firm's current share price, would you suggest moving forward with the acquisition? Why or why not?