Home /

Expert Answers /

Statistics and Probability /

internet-tax-in-2013-a-consulting-company-asked-1031-u-s-adults-whether-they-believed-that-peopl-pa807

(Solved): Internet tax: In 2013, a consulting company asked 1031 U.S. adults whether they believed that peopl ...

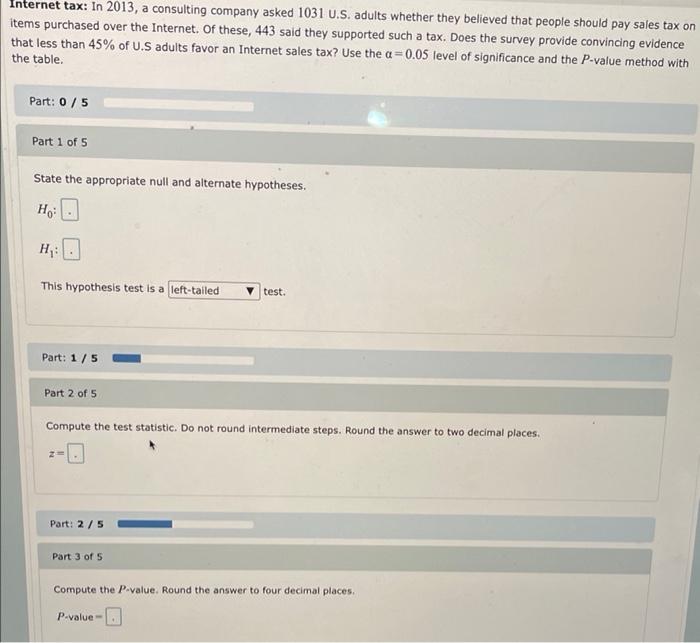

Internet tax: In 2013, a consulting company asked 1031 U.S. adults whether they believed that people should pay sales tax on items purchased over the Internet. Of these, 443 said they supported such a tax. Does the survey provide convincing evidence that less than 45% of U.S adults favor an Internet sales tax? Use the a=0.05 level of significance and the P-value method with the table. Part: 0/5 Part 1 of 5 State the appropriate null and alternate hypotheses. H: H: This hypothesis test is a left-tailed test. Part: 1/5 Part 2 of 5 Compute the test statistic. Do not round intermediate steps. Round the answer to two decimal places. Z Part: 2/5 Part 3 of 5 Compute the P-value. Round the answer to four decimal places. P-value

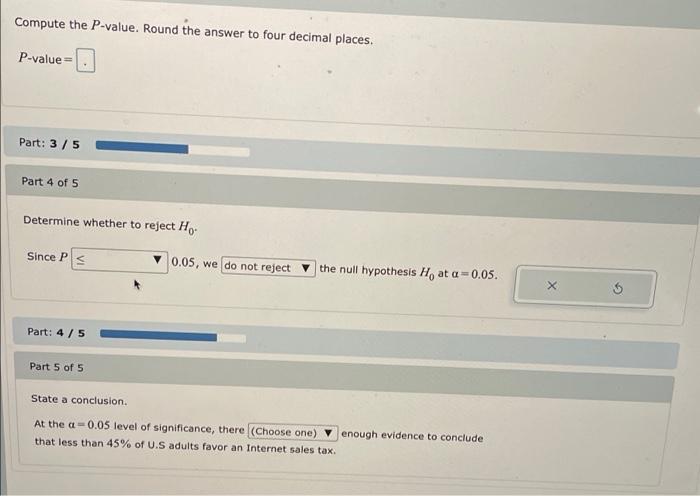

Compute the P-value. Round the answer to four decimal places. P-value = Part: 3/5 Part 4 of 5 Determine whether to reject H Since P 3 0.05, we do not reject the null hypothesis H, at a=0.05. Part: 4/5 Part 5 of 5 State a conclusion At the a=0.05 level of significance, there (Choose one) enough evidence to conclude that less than 45% of U.S adults favor an Internet sales tax.

Expert Answer

Given that, n = 1031 and x = 443 => sample proportion = 443/1031 = 0.4297 Part 1) The null and alternative hyp