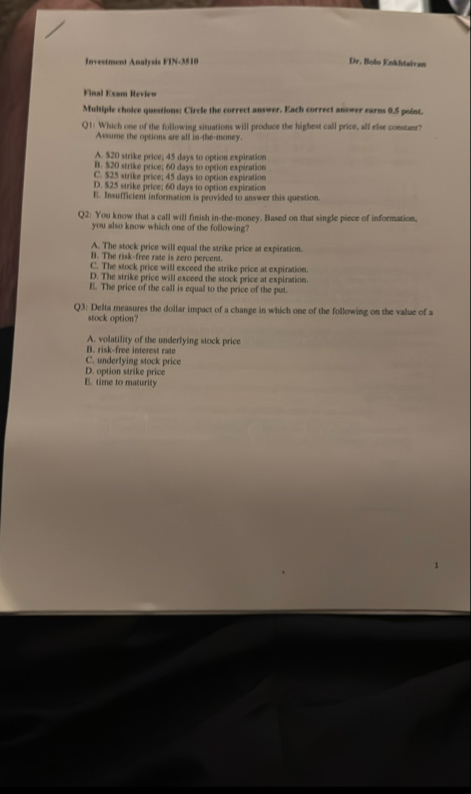

(Solved): Inv**tment Asalysis ITN.3819 Dr, Bole FinbMalvan Ihal I xam Hevlew Afuttpte rtantce questlonsi Circl ...

Inv**tment Asalysis ITN.3819 Dr, Bole FinbMalvan Ihal I xam Hevlew Afuttpte rtantce questlonsi Circle the correct answer, Nach correct answer narns 0.5 point. Assume the options are all in-the-money, A. 520 sirike price; 45 days to option expiration D.

520strike price; 60 days to option expiration C 525 strike frice; 45 days to option expination f) e36 tritcpitce tat diys io opition expirimion Insuficient information is provided to answer this question. Yeakiow that a eali witl finishin-the-money. Itased on that single piece of information, you aloo know which one of the following? A. The stock price will equal the strike price at expiration. B. The risk-free rate is zero pervent. C. The stock firice will excecd the strike price at explination. The sirike price will esceed the mock price at expination. The price of the call is equal to the price of the put. Q1. Delte-mensuies the dollar impact of a change in whikh one of the following on the value of a stock option? A. volatility of the underlying stock price D. risk-free interest rate C. inderlying sock price D. opion strike price B. time to maturity 1