(Solved): Ivanhoe Company began operations on January 1,2023, and uses the average-cost method of pricing inve ...

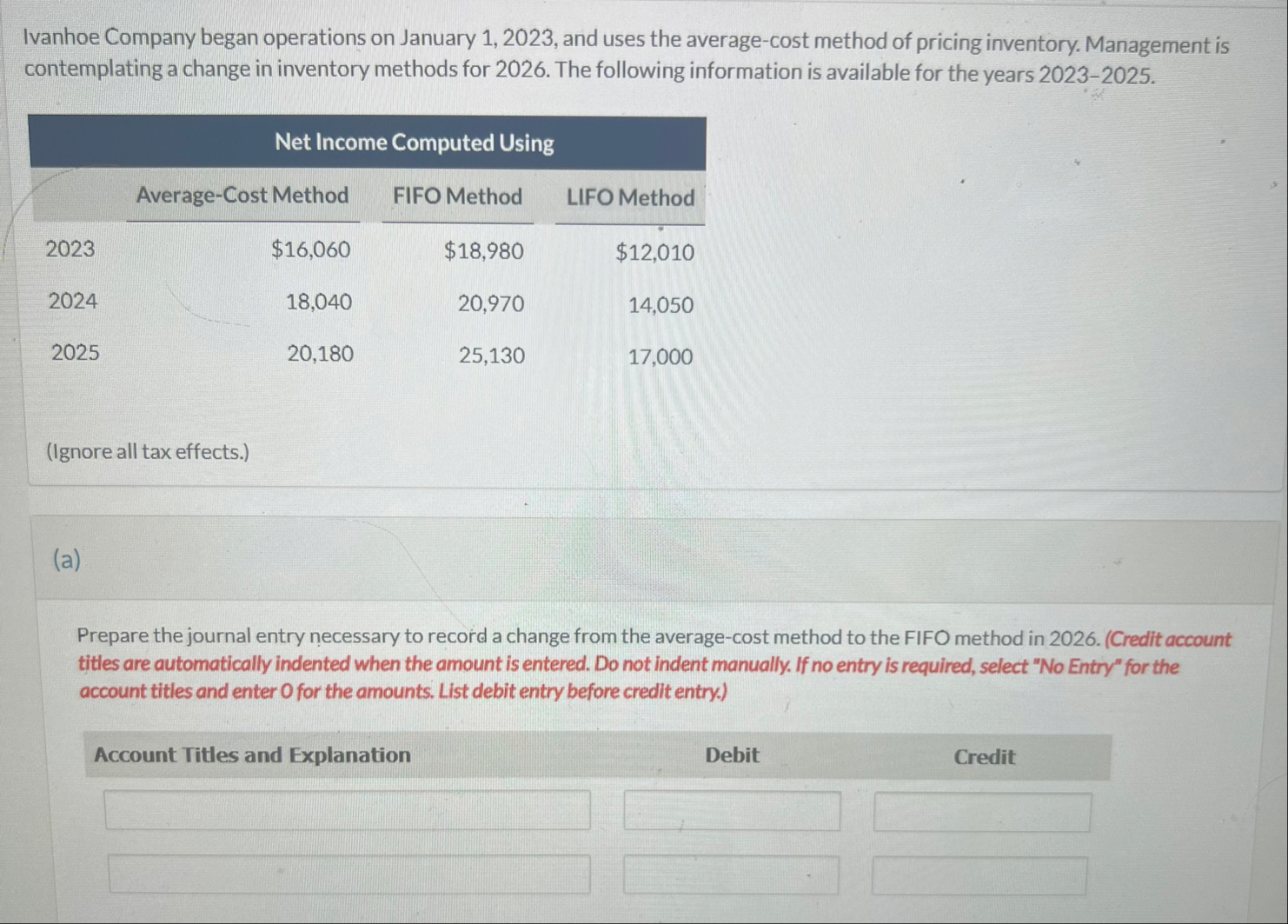

Ivanhoe Company began operations on January 1,2023, and uses the average-cost method of pricing inventory. Management is contemplating a change in inventory methods for 2026. The following information is available for the years 2023-2025. \table[[Net Income Computed Using,],[,Average-Cost Method,,FIFO Method,],[2023,

$16,060,,LIFO Method,],[2024,18,040,,

$18,980,],[2025,20,180,,

$12,010,],[,,,25,130,]] (Ignore all tax effects.) (a) Prepare the journal entry necessary to record a change from the average-cost method to the FIFO method in 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Credit

◻2/2

◻

◻

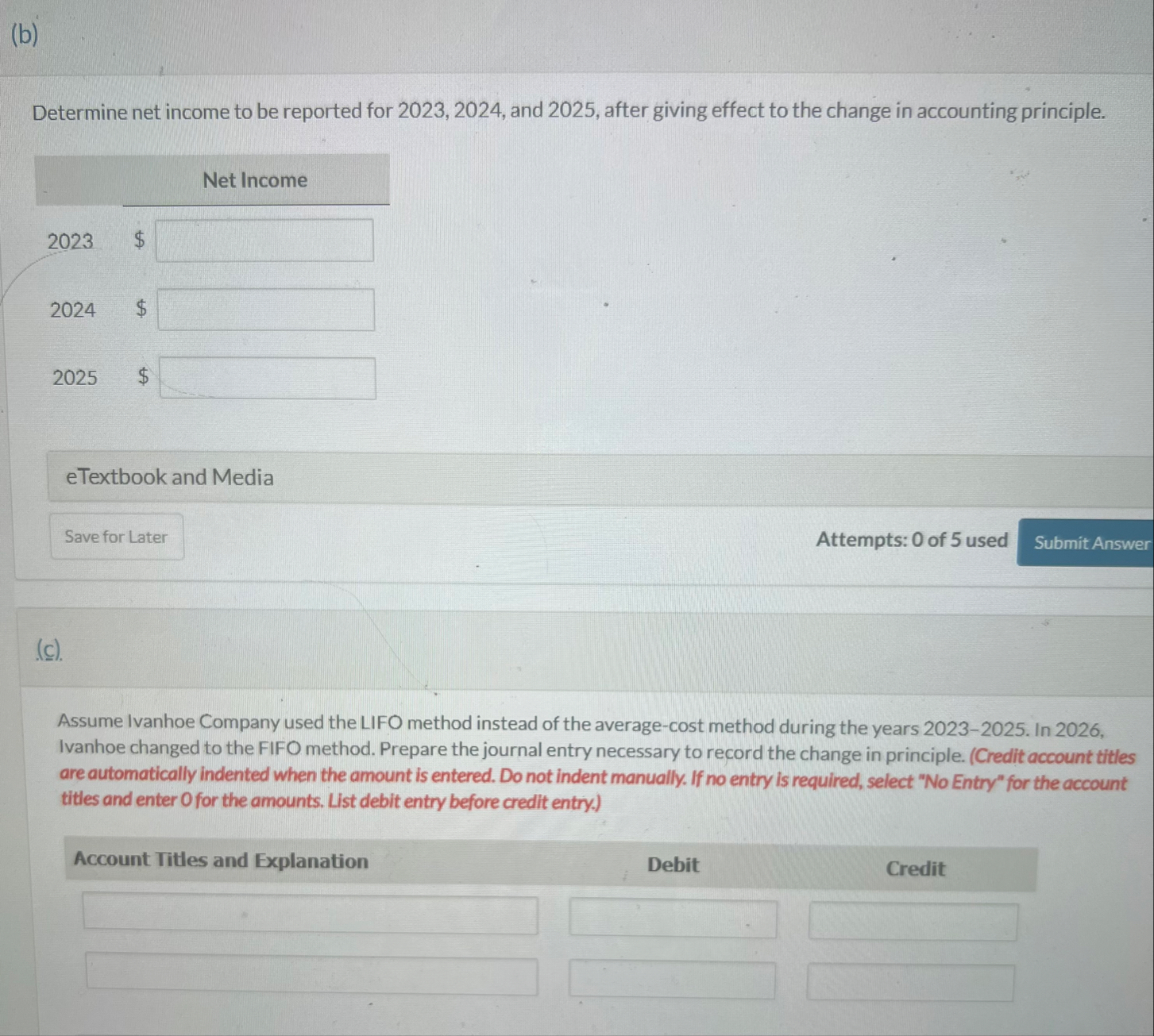

◻(b) Determine net income to be reported for 2023, 2024, and 2025, after giving effect to the change in accounting principle. Net Income 2023 $

◻2024 $

◻2025 $

◻eTextbook and Media Attempts: 0 of 5 used

◻(c). Assume Ivanhoe Company used the LIFO method instead of the average-cost method during the years 2023-2025. In 2026, Ivanhoe changed to the FIFO method. Prepare the journal entry necessary to record the change in principle. (Credit account titles are outomatically indented when the amount is entered. Do not indent manualfy. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Account Titles and Explanation Debit Credit

◻

◻

◻