Home /

Expert Answers /

Accounting /

jan-harding-accepted-an-employment-transfer-from-british-columbia-to-ontario-in-2022-she-will-begi-pa664

(Solved): Jan Harding accepted an employment transfer from British Columbia to Ontario in 2022. She will begi ...

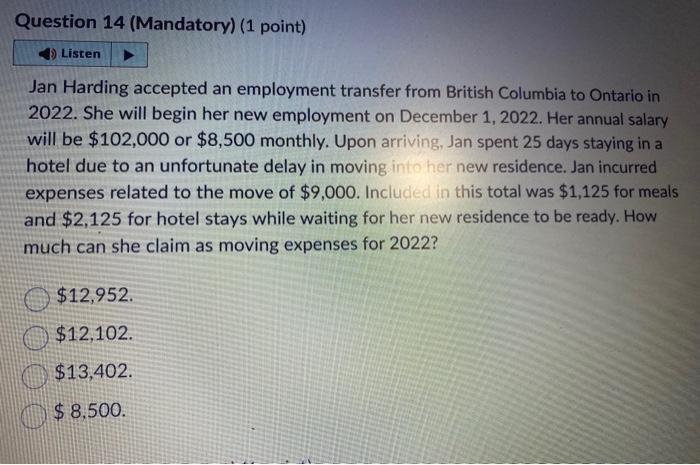

Jan Harding accepted an employment transfer from British Columbia to Ontario in 2022. She will begin her new employment on December 1,2022 . Her annual salary will be or monthly. Upon arriving, Jan spent 25 days staying in a hotel due to an unfortunate delay in moving into her new residence. Jan incurred expenses related to the move of . Included in this total was for meals and for hotel stays while waiting for her new residence to be ready. How much can she claim as moving expenses for 2022 ? . . . .

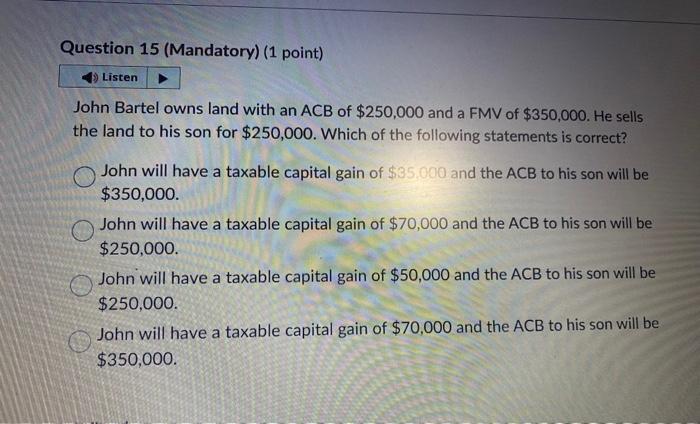

John Bartel owns land with an ACB of and a FMV of . He sells the land to his son for . Which of the following statements is correct? John will have a taxable capital gain of and the ACB to his son will be . John will have a taxable capital gain of and the ACB to his son will be . John will have a taxable capital gain of and the ACB to his son will be . John will have a taxable capital gain of and the ACB to his son will be .