(Solved): John wants to buy a property for $116,250 and wants an 80 percent loan for $93,000. A lender indica ...

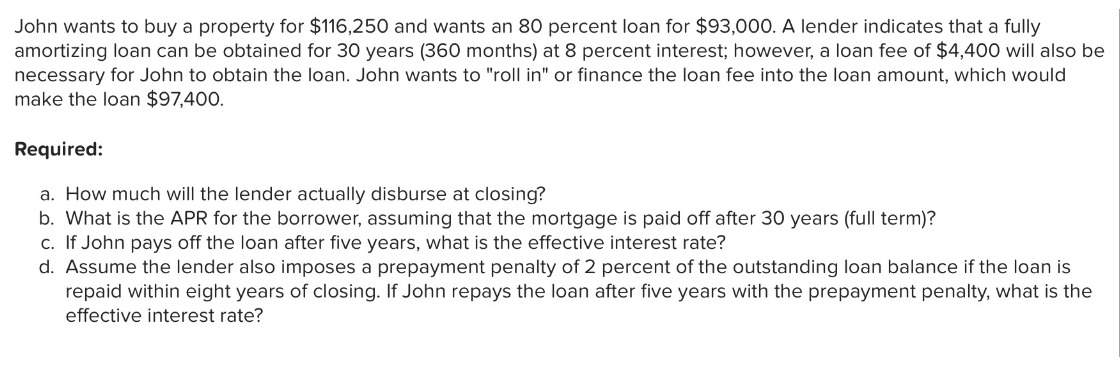

John wants to buy a property for

$116,250and wants an 80 percent loan for

$93,000. A lender indicates that a fully amortizing loan can be obtained for 30 years ( 360 months) at 8 percent interest; however, a loan fee of

$4,400will also be necessary for John to obtain the loan. John wants to "roll in" or finance the loan fee into the loan amount, which would make the loan

$97,400. Required: a. How much will the lender actually disburse at closing? b. What is the APR for the borrower, assuming that the mortgage is paid off after 30 years (full term)? c. If John pays off the loan after five years, what is the effective interest rate? d. Assume the lender also imposes a prepayment penalty of 2 percent of the outstanding loan balance if the loan is repaid within eight years of closing. If John repays the loan after five years with the prepayment penalty, what is the effective interest rate?