Home /

Expert Answers /

Accounting /

jonathan-transferred-90-000-of-cash-to-a-trust-this-yoar-for-the-beneft-of-harnah-age-10-the-trus-pa297

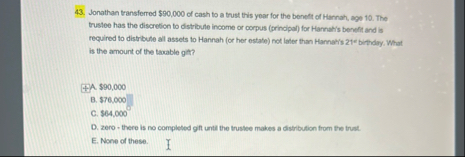

(Solved): Jonathan transferred $90,000 of cash to a trust this yoar for the beneft of Harnah, age 10. The trus ...

Jonathan transferred

$90,000of cash to a trust this yoar for the beneft of Harnah, age 10. The trustee has the discrefion to distribute income or corpus (prindpal) for Hannahis beneftitand is required to distribute all assets to Hannah (or her estate) not later than Hannat's

21^(2)bithdiy. What is the amount of the taxable gtt? A.

$90,000B.

$76.000C.

564,000\deg D. zero - there is no completed git unta the trustee makes a distribution from tre truat. E. None of these.