Home /

Expert Answers /

Accounting /

jorge-and-anita-married-taxpayers-earn-159-500-in-taxable-income-and-49-500-in-interest-from-an-pa703

(Solved): Jorge and Anita, married taxpayers, earn $159,500 in taxable income and $49,500 in interest from an ...

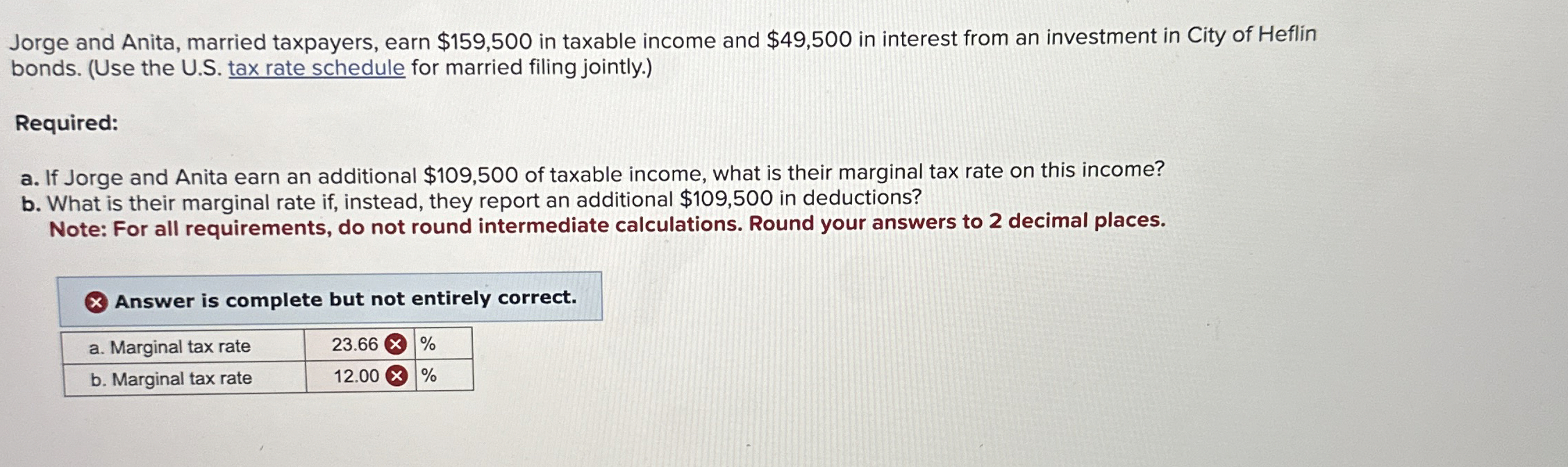

Jorge and Anita, married taxpayers, earn

$159,500in taxable income and

$49,500in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule for married filing jointly.) Required: a. If Jorge and Anita earn an additional

$109,500of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional

$109,500in deductions? Note: For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places. Answer is complete but not entirely correct. \table[[a. Marginal tax rate,

23.66⨂,

%