Home /

Expert Answers /

Finance /

ken-a-single-man-has-taxable-income-of-80-000-in-2022-what-is-ken-39-s-federal-tax-liabili-pa719

(Solved): Ken, a single man, has taxable income of \( \$ 80,000 \) in 2022. What is Ken's Federal tax liabili ...

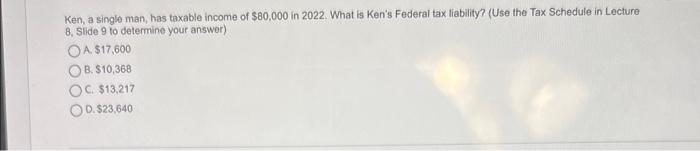

Ken, a single man, has taxable income of \( \$ 80,000 \) in 2022. What is Ken's Federal tax liability? (Use the Tax Schedule in Lecture 8. Slide 9 to determine your answer) A. \( \$ 17,600 \) B. \( \$ 10,368 \) C. \( \$ 13.217 \) D. \( \$ 23,640 \)

Expert Answer

Taxable income = $80,000 His taxable income is comes in $41,7