(Solved): Lewis filed his 2023 tax return on paper. Two weeks after filing, Lewis informed his tax preparer th ...

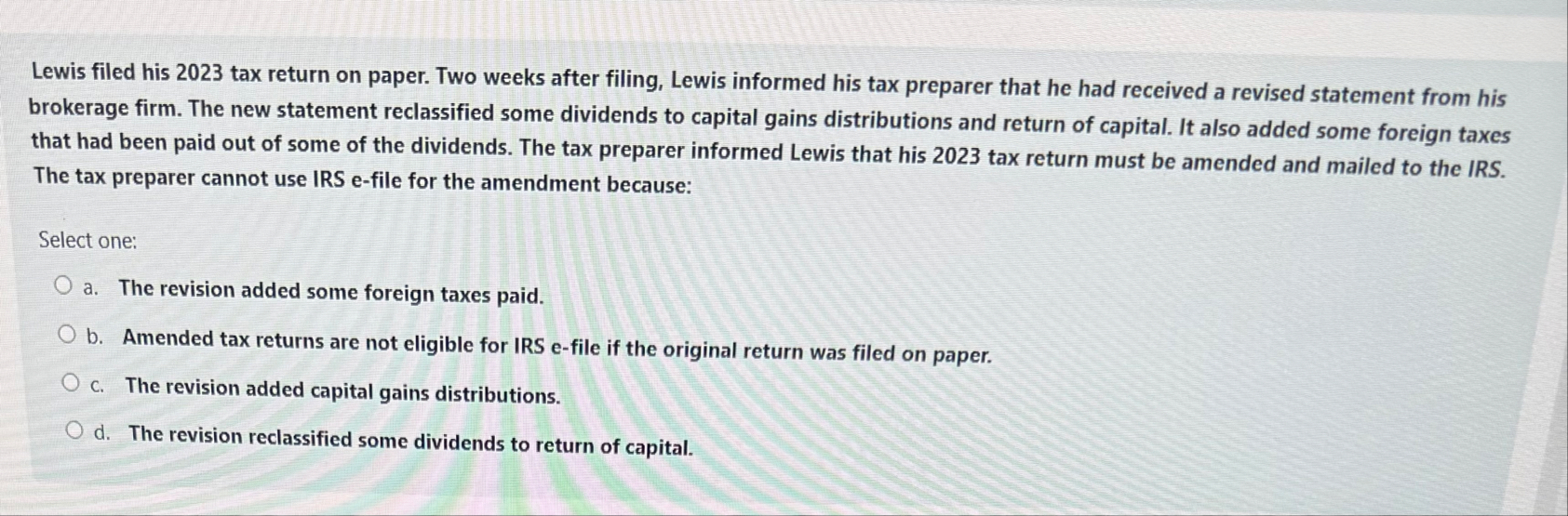

Lewis filed his 2023 tax return on paper. Two weeks after filing, Lewis informed his tax preparer that he had received a revised statement from his brokerage firm. The new statement reclassified some dividends to capital gains distributions and return of capital. It also added some foreign taxes that had been paid out of some of the dividends. The tax preparer informed Lewis that his 2023 tax return must be amended and mailed to the IRS. The tax preparer cannot use IRS e-file for the amendment because: Select one: a. The revision added some foreign taxes paid. b. Amended tax returns are not eligible for IRS e-file if the original return was filed on paper. c. The revision added capital gains distributions. d. The revision reclassified some dividends to return of capital.