Home /

Expert Answers /

Finance /

marvel-inc-stock-valuation-information-you-are-going-to-value-marvel-inc-using-the-free-cash-flow-pa414

(Solved): Marvel Inc. Stock Valuation Information You are going to value Marvel Inc. using the Free Cash Flow ...

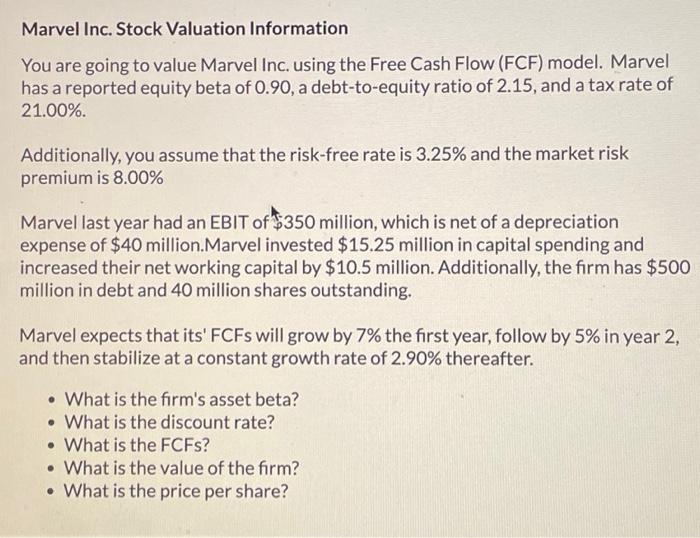

Marvel Inc. Stock Valuation Information You are going to value Marvel Inc. using the Free Cash Flow (FCF) model. Marvel has a reported equity beta of 0.90, a debt-to-equity ratio of 2.15, and a tax rate of 21.00%. Additionally, you assume that the risk-free rate is 3.25% and the market risk premium is 8.00% Marvel last year had an EBIT of $350 million, which is net of a depreciation expense of $40 million.Marvel invested $15.25 million in capital spending and increased their net working capital by $10.5 million. Additionally, the firm has $500 million in debt and 40 million shares outstanding. Marvel expects that its' FCFs will grow by 7% the first year, follow by 5% in year 2, and then stabilize at a constant growth rate of 2.90% thereafter. . What is the firm's asset beta? • What is the discount rate? . What is the FCFs? . What is the value of the firm? . What is the price per share?

You are going to value Marvel Inc. using the Free Cash Flow (FCF) model. Marvel has a reported equity beta of 0.90 , a debt-to-equity ratio of 2.15 , and a tax rate of . Additionally, you assume that the risk-free rate is and the market risk premium is Marvel last year had an EBIT of million, which is net of a depreciation expense of million.Marvel invested million in capital spending and increased their net working capital by million. Additionally, the firm has million in debt and 40 million shares outstanding. Marvel expects that its' FCFs will grow by the first year, follow by in year 2 , and then stabilize at a constant growth rate of thereafter. - What is the firm's asset beta? - What is the discount rate? - What is the FCFs? - What is the value of the firm? - What is the price per share?