Home /

Expert Answers /

Accounting /

mcginn-company-purchased-10-of-rj-company-39-s-common-stock-during-2019-for-100-000-the-10-investm-pa775

(Solved): McGinn Company purchased 10% of RJ Company's common stock during 2019 for $100,000. The 10% investm ...

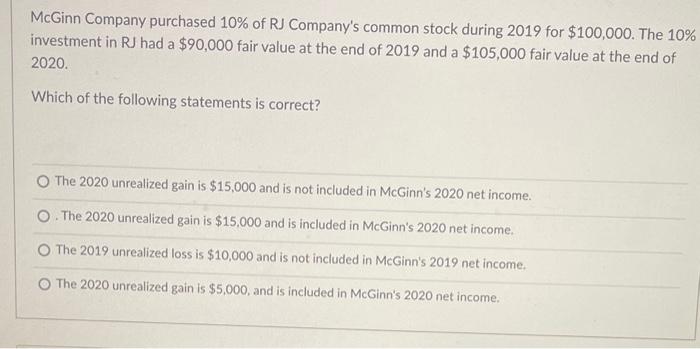

McGinn Company purchased of RJ Company's common stock during 2019 for . The investment in RJ had a fair value at the end of 2019 and a fair value at the end of 2020. Which of the following statements is correct? The 2020 unrealized gain is and is not included in McGinn's 2020 net income. . The 2020 unrealized gain is and is included in McGinn's 2020 net income. The 2019 unrealized loss is and is not included in McGinn's 2019 net income. The 2020 unrealized gain is , and is included in McGinn's 2020 net income.

Expert Answer

AnswerOption a) The 2020 unrealized gain is $15,000 and is not included in McGinn's 2020 net income.Explanation:When a company invests in the equity s