Home /

Expert Answers /

Finance /

mv-corporation-has-debt-with-market-value-of-101-million-common-equity-with-a-book-value-of-98-mi-pa350

(Solved): MV Corporation has debt with market value of $101 million, common equity with a book value of $98 mi ...

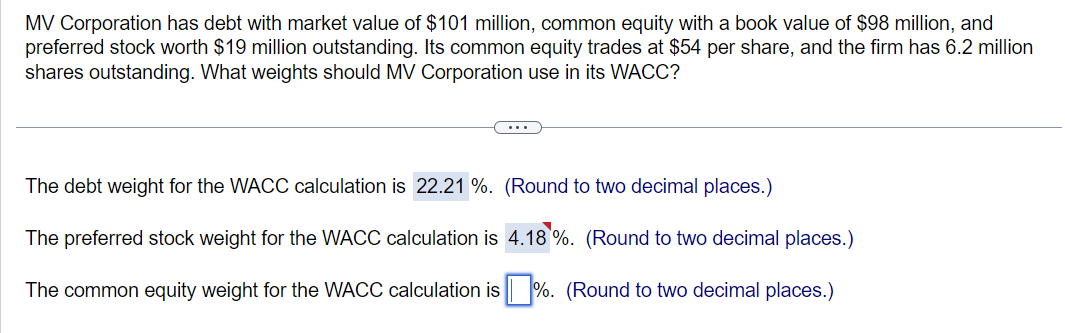

MV Corporation has debt with market value of

$101million, common equity with a book value of

$98million, and preferred stock worth

$19million outstanding. Its common equity trades at

$54per share, and the firm has 6.2 million shares outstanding. What weights should MV Corporation use in its WACC? The debt weight for the WACC calculation is

%. (Round to two decimal places.) The preferred stock weight for the WACC calculation is

4.18%. (Round to two decimal places.) The common equity weight for the WACC calculation is

%. (Round to two decimal places.)