Home /

Expert Answers /

Finance /

nbsp-my-question-posted-i-believe-expert-did-it-wrong-wouldn-39-t-it-be-to-the-power-of-6-not-pa735

(Solved): my question posted, i believe expert did it wrong. wouldn't it be to the power of ^6 not ^ ...

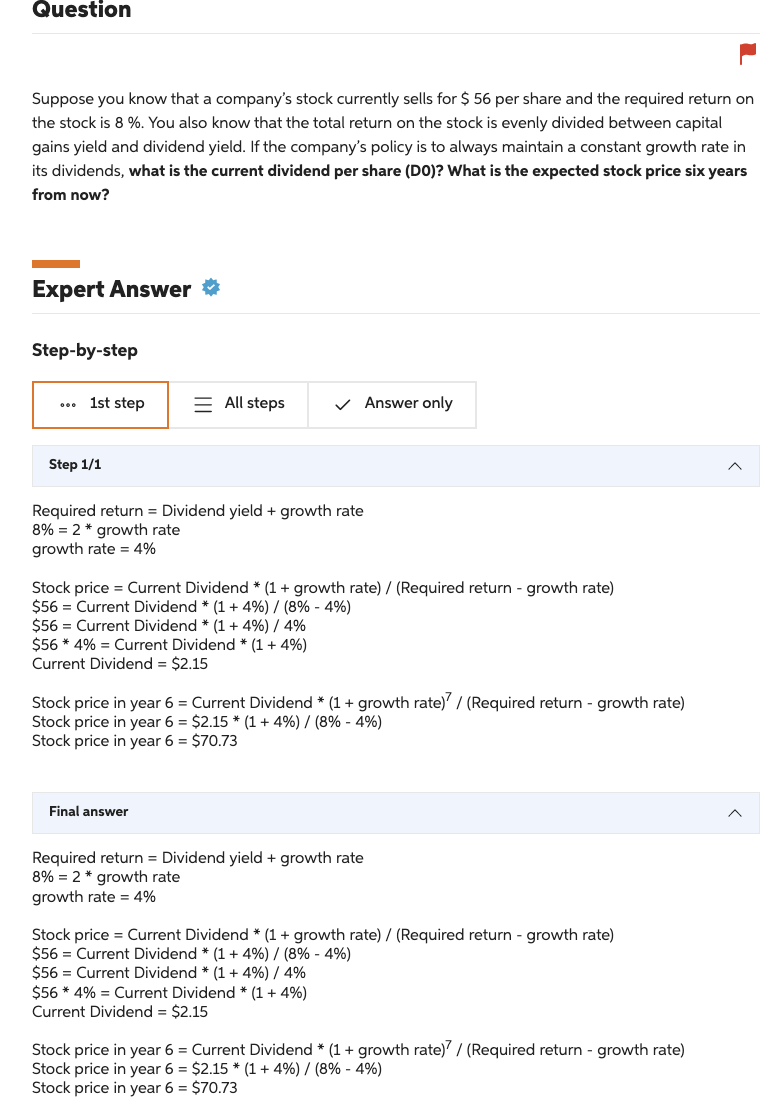

my question posted, i believe expert did it wrong. wouldn't it be to the power of ^6 not ^7 since we want stock price in year 6?

Suppose you know that a company's stock currently sells for \( \$ 56 \) per share and the required return on the stock is \( 8 \% \). You also know that the total return on the stock is evenly divided betwen gains yield and dividend yield. If the company's policy is to always maintain a constant growth rate in its dividends, what is the current dividend per share (DO)? What is the expected stock price six years from now? Expert Answer Step-by-step Step 1/1 Required return \( = \) Dividend yield \( + \) growth rate \( 8 \%=2{ }^{*} \) growth rate growth rate \( =4 \% \) Stock price \( = \) Current Dividend * \( (1+ \) growth rate \( ) / \) (Required return \( - \) growth rate \( ) \) \( \$ 56= \) Current Dividend * \( (1+4 \%) /(8 \%-4 \%) \) \( \$ 56= \) Current Dividend * \( (1+4 \%) / 4 \% \) \( \$ 56 * 4 \%= \) Current Dividend * \( (1+4 \%) \) Current Dividend \( =\$ 2.15 \) Stock price in year \( 6= \) Current Dividend * \( (1+\text { growth rate })^{7} / \) (Required return - growth rate) Stock price in year \( 6=\$ 2.15 *(1+4 \%) /(8 \%-4 \%) \) Stock price in year \( 6=\$ 70.73 \) Final answer Required return \( = \) Dividend yield \( + \) growth rate \( 8 \%=2 * \) growth rate growth rate \( =4 \% \) Stock price \( = \) Current Dividend \( { }^{*}(1+ \) growth rate \( ) /( \) Required return \( - \) growth rate \( ) \) \( \$ 56= \) Current Dividend * \( (1+4 \%) /(8 \%-4 \%) \) \( \$ 56= \) Current Dividend * \( (1+4 \%) / 4 \% \) \( \$ 56 * 4 \%= \) Current Dividend * \( (1+4 \%) \) Current Dividend \( =\$ 2.15 \) Stock price in year \( 6= \) Current Dividend * \( (1+\text { growth rate })^{7} / \) ( Required return \( - \) growth rate \( ) \) Stock price in year \( 6=\$ 2.15 *(1+4 \%) /(8 \%-4 \%) \) Stock price in year \( 6=\$ 70.73 \)

Expert Answer

Growth rate =Required return / 2=8%2=0.04