(Solved): NPV unequal lives. Singing Fish Fine Foods has $1,920,000 for capital investments this year and is c ...

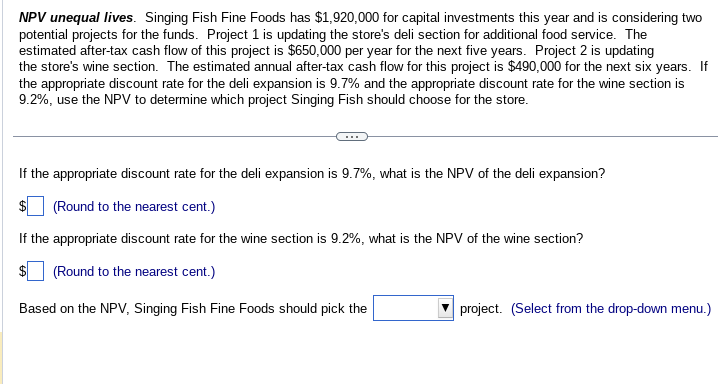

NPV unequal lives. Singing Fish Fine Foods has

$1,920,000for capital investments this year and is considering two potential projects for the funds. Project 1 is updating the store's deli section for additional food service. The estimated after-tax cash flow of this project is

$650,000per year for the next five years. Project 2 is updating the store's wine section. The estimated annual after-tax cash flow for this project is

$490,000for the next six years. If the appropriate discount rate for the deli expansion is

9.7%and the appropriate discount rate for the wine section is

9.2%, use the NPV to determine which project Singing Fish should choose for the store. If the appropriate discount rate for the deli expansion is

9.7%, what is the NPV of the deli expansion?

$,(Round to the nearest cent.) If the appropriate discount rate for the wine section is

9.2%, what is the NPV of the wine section?

$(Round to the nearest cent.) Based on the NPV, Singing Fish Fine Foods should pick the project. (Select from the drop-down menu.)