(Solved): Oct. 1 Graham invested $90,000 cash, a $36,000 computer system, and $18,000 of office equipment in t ...

Oct. 1 Graham invested

$90,000cash, a

$36,000computer system, and

$18,000of office equipment in the business. 2 Paid rent in advance of

$9,000. 3 Purchased computer supplies on credit for

$2,640from Abbott Office Products. 5 Paid

$4,320cash for one year's premium on a property and liability insurance policy. 6 Billed Capital Leasing

$6,600for installing a new computer. 8 Paid for the computer supplies purchased from Abbott Office Products. 10 Hired Carly Smith as a part-time assistant for

$200per day, as needed. 12 Billed Capital Leasing another

$2,400for computer services rendered. 15 Received

$6,600from Capital Leasing on its account. 17 Paid

$1,410to repair computer equipment damaged when moving into the new office. 20 Paid

$3,720for an advertisement in the local newspaper. 22 Received

$2,400from Capital Leasing on its account. 28 Billed Decker Company

$6,450for services. 31 Paid Carly Smith for seven days' work. 31 Withdrew

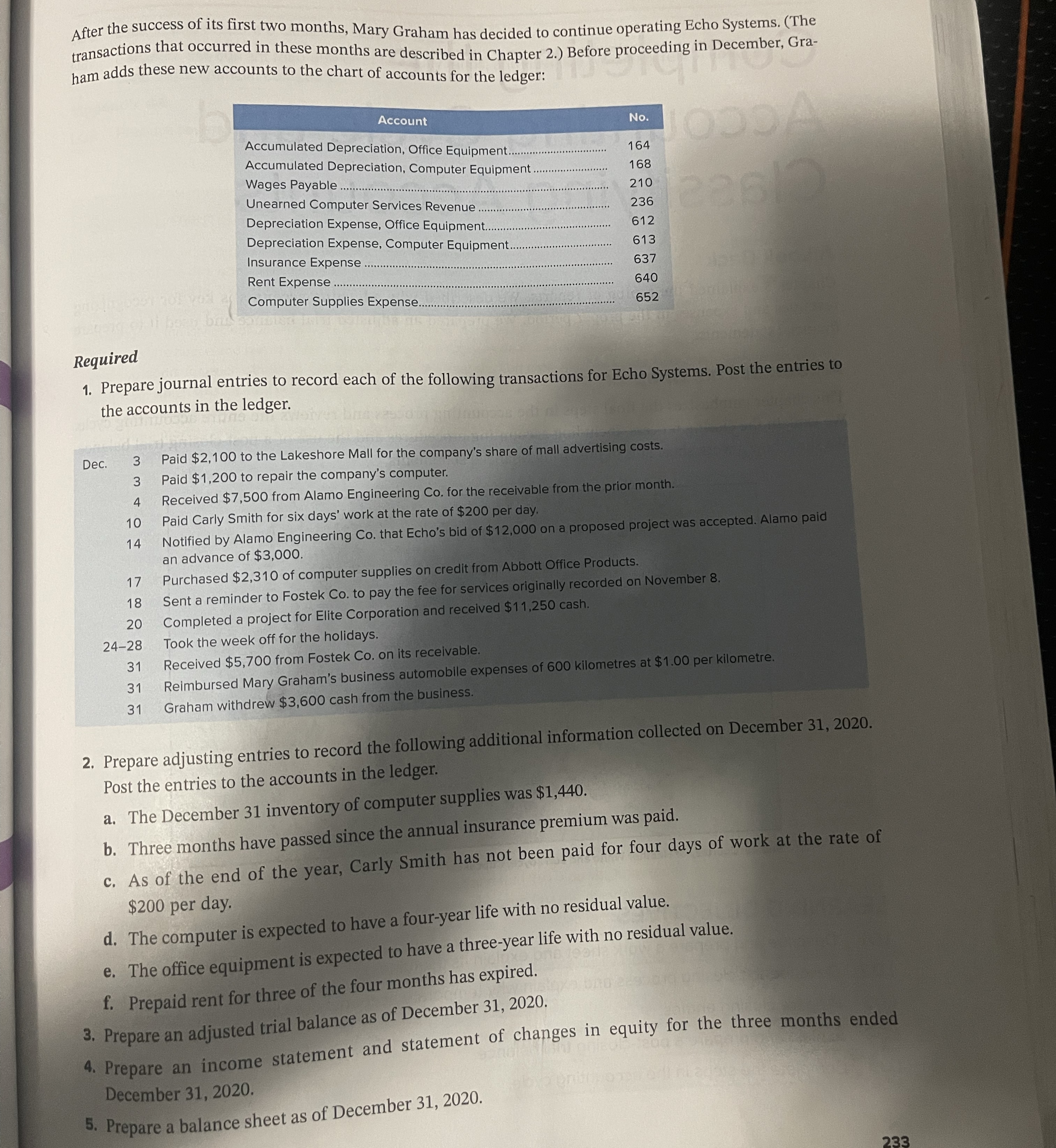

$7,200cash from the business for personal use. Part B: CHECK FIGURES: 8. Total Dr.

=$184,950;9. Profit

=$27,920;Total assets

=$161,120Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at November 30, 2020. Nov. 1 Reimbursed Graham's business automobile expense for 1,000 kilometres at

$1.00per kilometre. 2 Received

$9,300cash from Elite Corporation for computer services rendered. 5 Purchased

$1,920of computer supplies for cash from Abbott Office Products. 8 Billed Fostek Co.

$8,700for computer services rendered. 13 Notified by Alamo Engineering Co. that Echo's bid of

$7,500for an upcoming project was accepted. 18 Received

$3,750from Decker Company against the bill dated October 28. 22 Donated

$1,500to the United Way in the company's name. 24 Completed work for Alamo Engineering Co. and sent a bill for

$7,500. 25 Sent another bill to Decker Company for the past due amount of

$2,700. 28 Reimbursed Graham's business automobile expense for 1,200 kilometres at

$1.00per kilometre. 30 Paid Carly Smith for 14 days' work. 30 Withdrew

$3,600cash from the business for personal use.