Home /

Expert Answers /

Accounting /

on-october-1-organic-farming-purchases-wind-turbines-for-240-000-the-wind-turbines-are-expected-pa577

(Solved): On October 1, Organic Farming purchases wind turbines for $240,000. The wind turbines are expected ...

![Required Information

[The following information applies to the questions displayed below]

On January 1, the Matthews Band pay](https://media.cheggcdn.com/study/74b/74b78e84-7d86-48de-a6ce-0adb05459b1b/image)

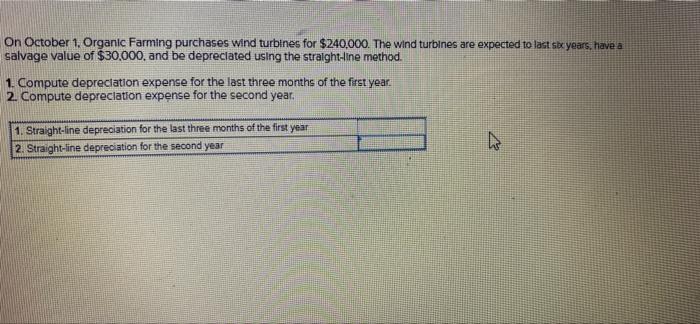

On October 1, Organic Farming purchases wind turbines for $240,000. The wind turbines are expected to last six years, have a salvage value of $30,000, and be depreciated using the straight-line method. 1. Compute depreciation expense for the last three months of the first year. 2. Compute depreciation expense for the second year. 1. Straight-line depreciation for the last three months of the first year 2. Straight-line depreciation for the second year 4

Required Information [The following information applies to the questions displayed below] On January 1, the Matthews Band pays $68,400 for sound equipment. The band estimates It will use this equipment for four years and perform 200 concerts. It estimates that after four years it can sell the equipment for $1,000. During the first year, the band performs 45 concerts. Compute the first-year depreciation using the straight-line method. Straight-Line Depreciation Annual Depreciation Experise Choose Denominator Choose Numerator Cost minus salvage Estimated useful life (years) Depreciation expense 15.165

Expert Answer

Solution 1. Calculation of Depreciation expenses for last three months of the first year Depreciation expense p.a. = ( Original cost - savage value ) / useful life Whereas, Original cost = $ 2,40,000 Salvage valu