Home /

Expert Answers /

Accounting /

part-3-of-3-5-16points-ebook-print-references-check-my-workcheck-my-work-button-is-now-enabled-item-pa775

(Solved): Part 3 of 3 5.16points eBook Print References Check my workCheck My Work button is now enabled Item ...

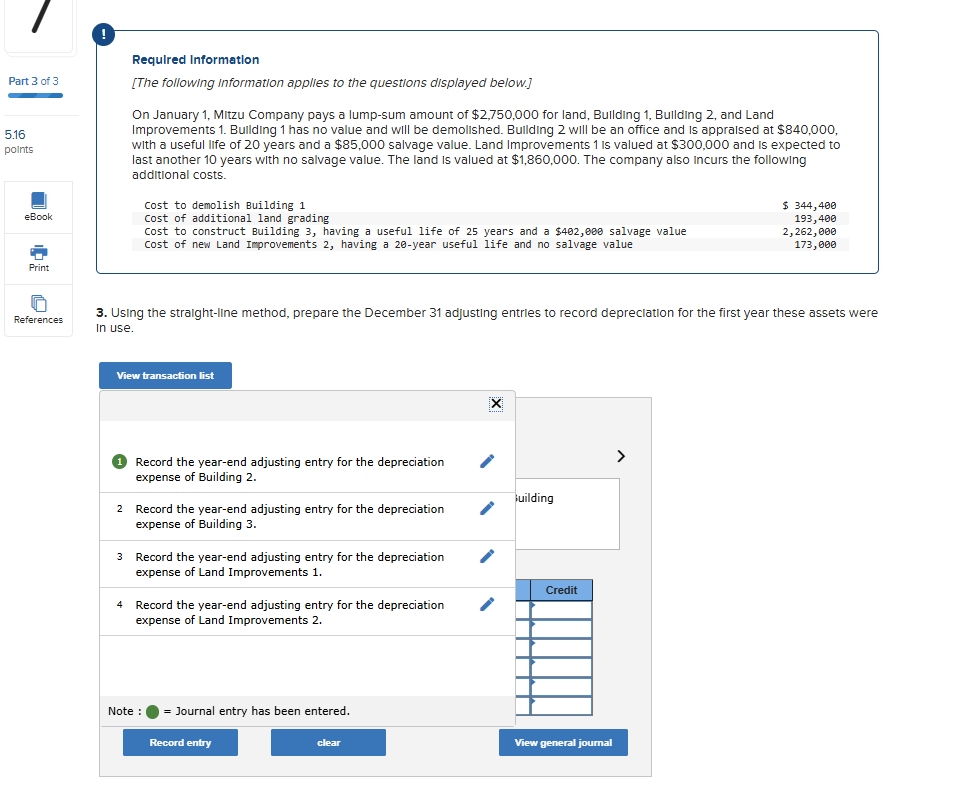

Part 3 of 3 5.16points eBook Print References Check my workCheck My Work button is now enabled Item 7 Required information Skip to question [The following information applies to the questions displayed below.] On January 1, Mitzu Company pays a lump-sum amount of $2,750,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $840,000, with a useful life of 20 years and a $85,000 salvage value. Land Improvements 1 is valued at $300,000 and is expected to last another 10 years with no salvage value. The land is valued at $1,860,000. The company also incurs the following additional costs. Cost to demolish Building 1$ 344,400Cost of additional land grading193,400Cost to construct Building 3, having a useful life of 25 years and a $402,000 salvage value2,262,000Cost of new Land Improvements 2, having a 20-year useful life and no salvage value173,000 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use.

!

Required Information

[The following Information applles to the questions displayed below.]

On January 1, Mitzu Company pays a lump-sum amount of $2,750,000 for land, Bullding 1, Bullding 2, and Land

Improvements 1. Bullding 1 has no value and will be demolished. Bullding 2 will be an office and is appralsed at $840,000,

with a useful life of 20 years and a $85,000 salvage value. Land Improvements 1 Is valued at $300,000 and is expected to

last another 10 years with no salvage value. The land is valued at $1,860,000. The company also incurs the following

additional costs.

Using the straight-line method, prepare the December 31 adjusting entrles to record depreclation for the first year these assets were

In use.

Record the year-end adjusting entry for the depreciation

expense of Building 2.

>

2 Record the year-end adjusting entry for the depreciation

expense of Building 3 .

building

3 Record the year-end adjusting entry for the depreciation

expense of Land Improvements 1.

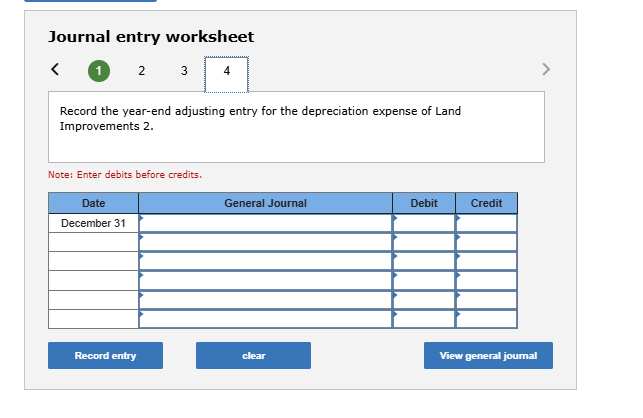

4 Record the year-end adjusting entry for the depreciation

expense of Land Improvements 2.

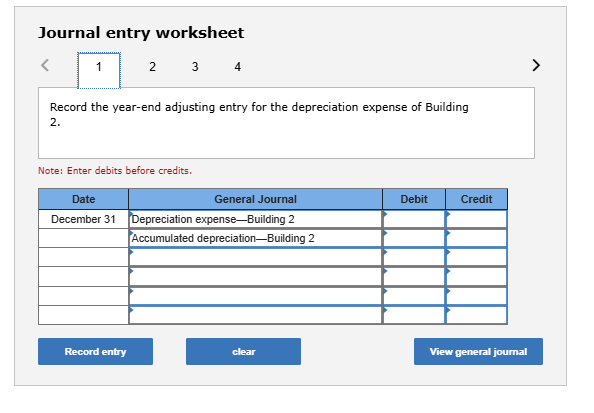

Journal entry worksheet

Record the year-end adjusting entry for the depreciation expense of Building

Note: Enter debits before credits.

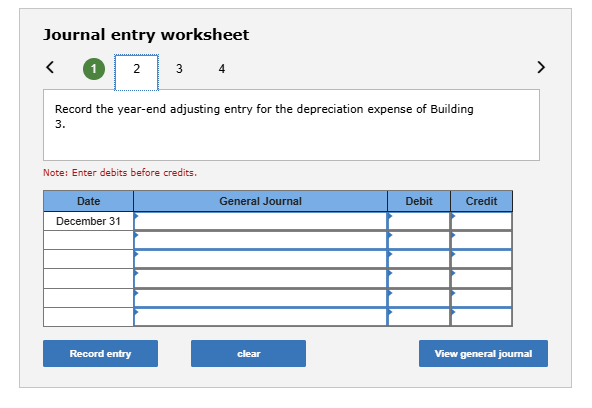

Journal entry worksheet

1

3

4

Record the year-end adjusting entry for the depreciation expense of Building

Note: Enter debits before credits.

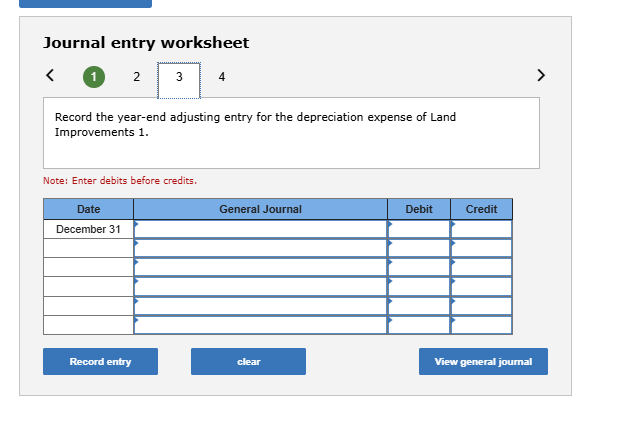

Journal entry worksheet

2

3

4

Record the year-end adjusting entry for the depreciation expense of Land Improvements 1 .

Note: Enter debits before credits.

\table[[Date,General Journal],[Debit,Credit],[December 31,],[,],[,],[,],[,],[,],[,],[,],[,],[,],[,],[,]]

Journal entry worksheet

(1) 2,3,4

Record the year-end adjusting entry for the depreciation expense of Land

Improvem