Home /

Expert Answers /

Finance /

part-c-short-answer-question-60-problem-15-investment-mechanism-and-expected-returns-risks-2-pa880

(Solved): Part C: Short answer question ( 60% ) Problem 15: Investment mechanism and expected returns/risks (2 ...

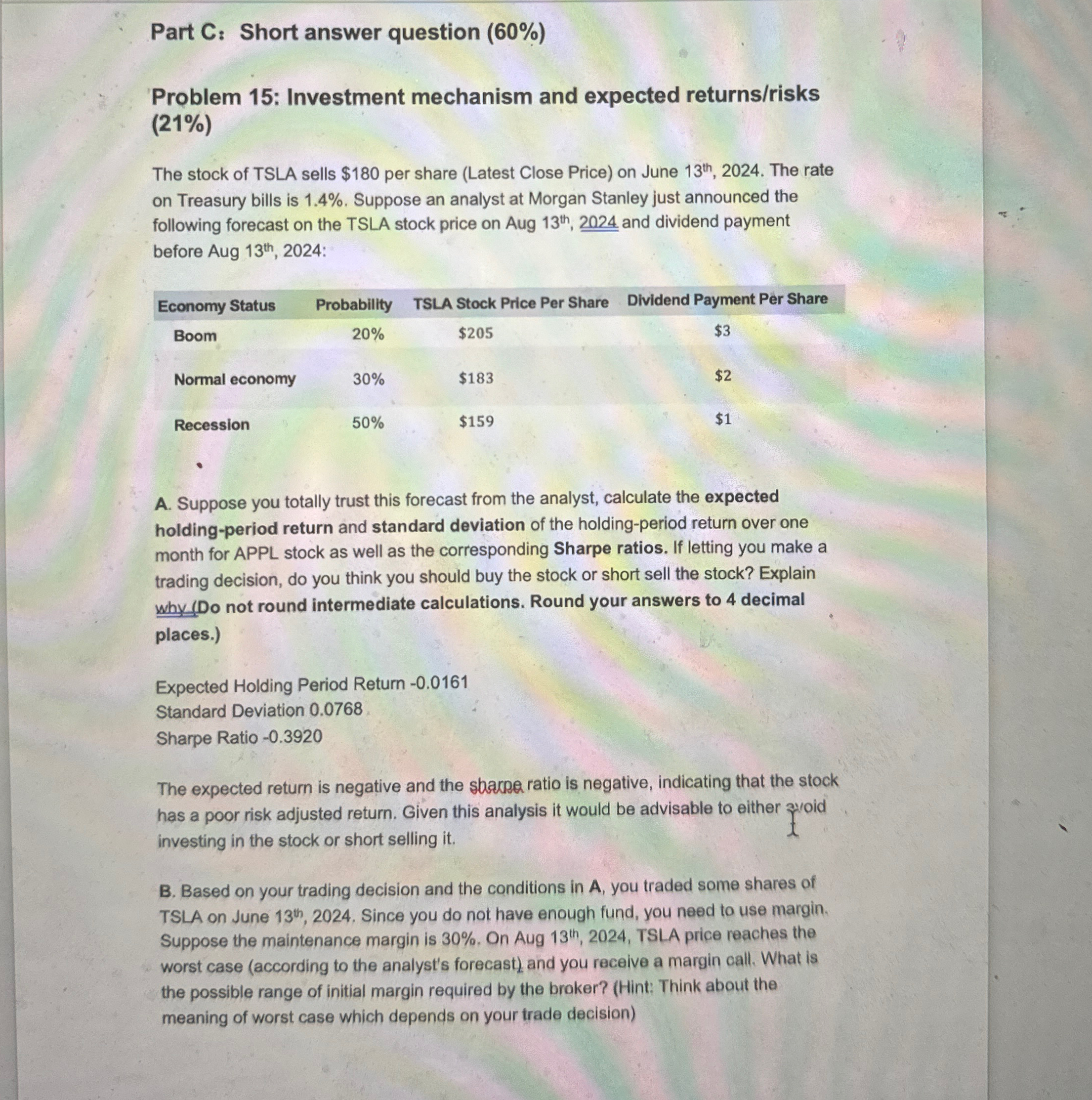

Part C: Short answer question (

60%) Problem 15: Investment mechanism and expected returns/risks (21%) The stock of TSLA sells

$180per share (Latest Close Price) on June

13^(th ),2024. The rate on Treasury bills is

1.4%. Suppose an analyst at Morgan Stanley just announced the following forecast on the TSLA stock price on Aug

13^(th ),2024_()and dividend payment before Aug

13^(th ),2024: \table[[Economy Status,Probability,TSLA Stock Price Per Share,Dividend Payment Per Share],[Boom,

20%,

$205,

$3