Home /

Expert Answers /

Operations Management /

part-ii-change-janet-39-s-schedule-in-question-5-above-you-calculated-what-the-schedule-would-look-l-pa777

(Solved): Part II: Change Janet's Schedule In question 5 above, you calculated what the schedule would look l ...

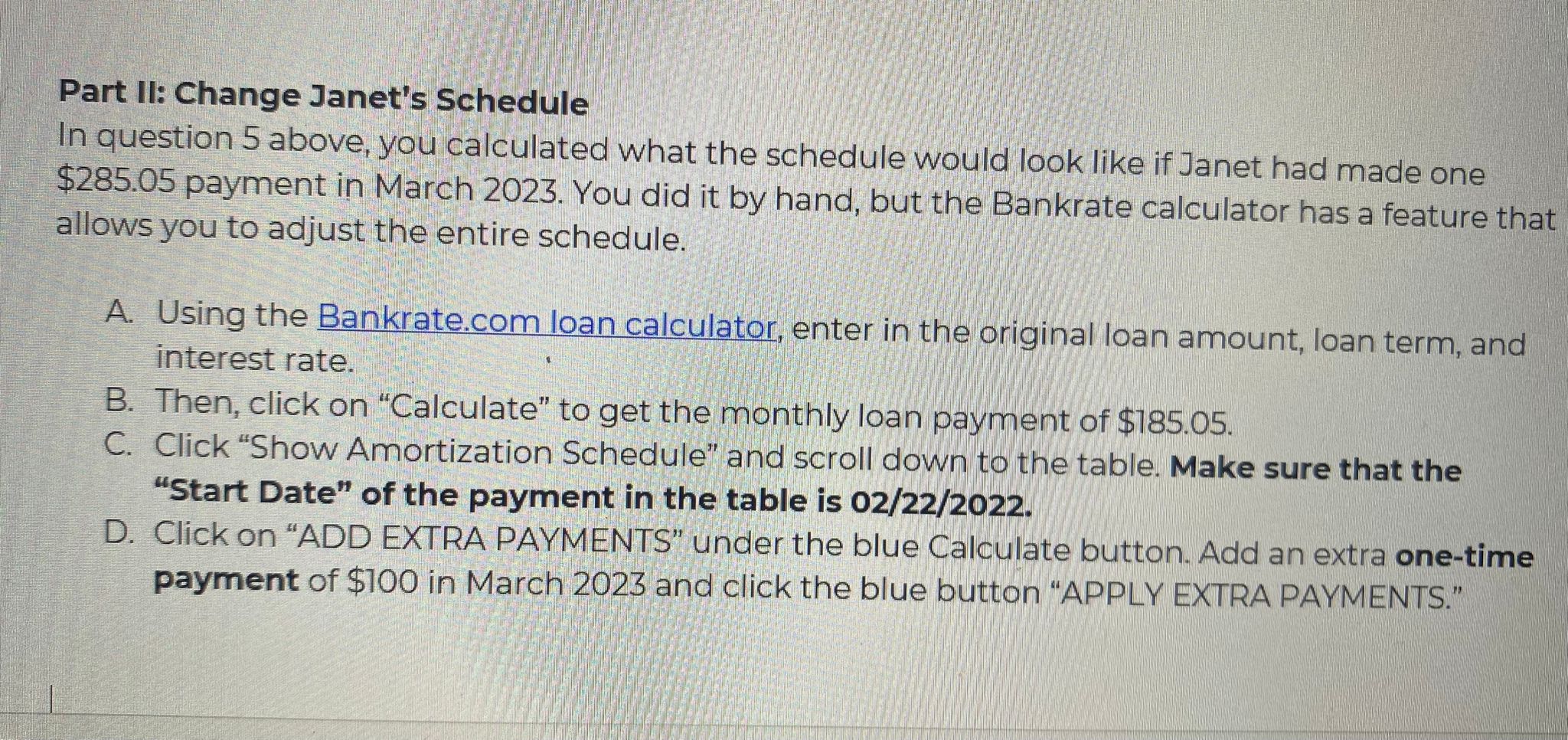

Part II: Change Janet's Schedule In question 5 above, you calculated what the schedule would look like if Janet had made one payment in March 2023. You did it by hand, but the Bankrate calculator has a feature that allows you to adjust the entire schedule. A. Using the Bankrate.com loan calculator, enter in the original loan amount, loan term, and interest rate. B. Then, click on "Calculate" to get the monthly loan payment of . C. Click "Show Amortization Schedule" and scroll down to the table. Make sure that the "Start Date" of the payment in the table is 02/22/2022. D. Click on "ADD EXTRA PAYMENTS" under the blue Calculate button. Add an extra one-time payment of in March 2023 and click the blue button "APPLY EXTRA PAYMENTS."

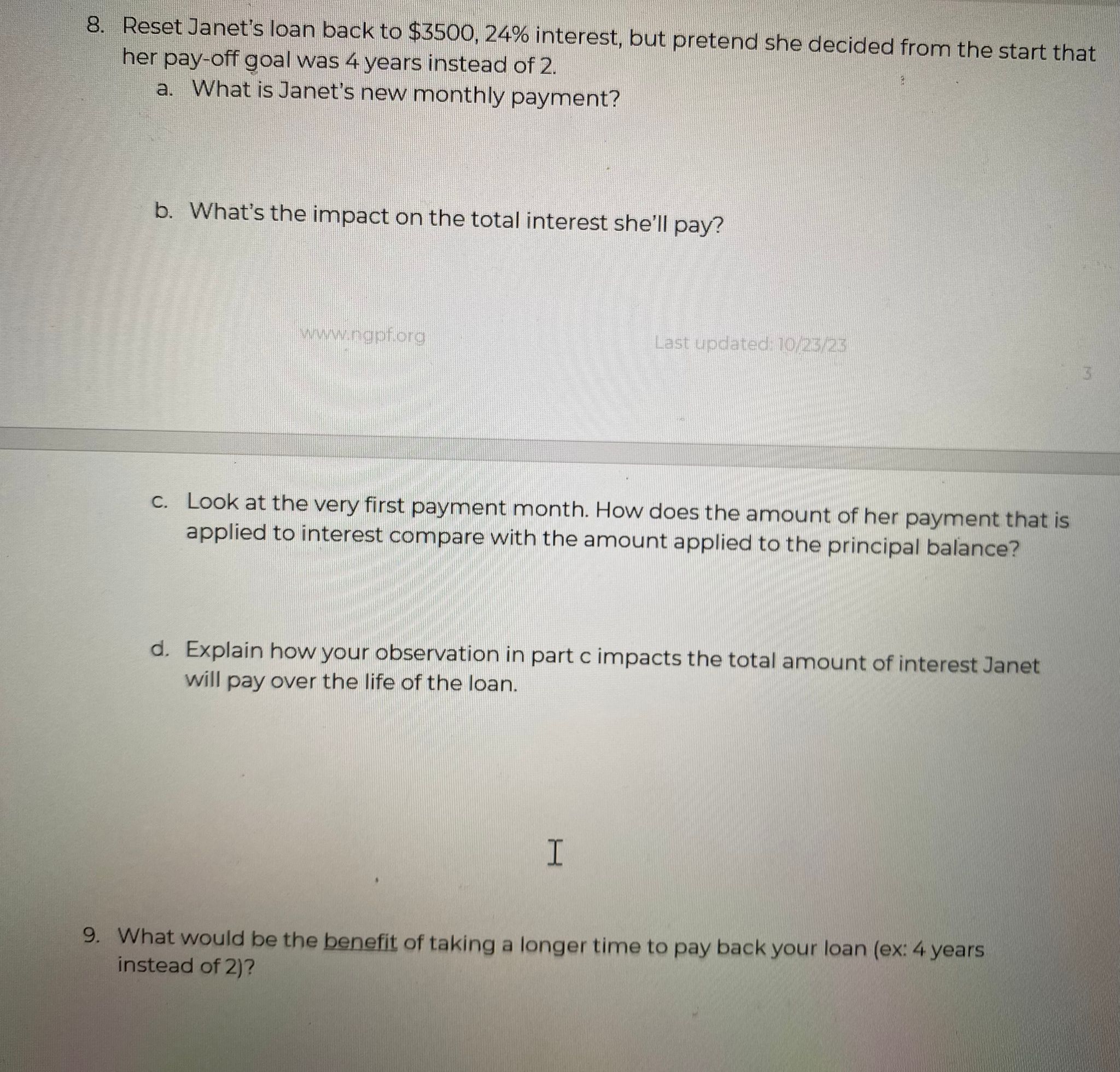

8. Reset Janet's loan back to interest, but pretend she decided from the start that her pay-off goal was 4 years instead of 2. a. What is Janet's new monthly payment? b. What's the impact on the total interest she'll pay? www.ngpforg Last updated: c. Look at the very first payment month. How does the amount of her payment that is applied to interest compare with the amount applied to the principal balance? d. Explain how your observation in part c impacts the total amount of interest Janet will pay over the life of the loan. 9. What would be the benefit of taking a longer time to pay back your loan (ex: 4 years instead of 2)?

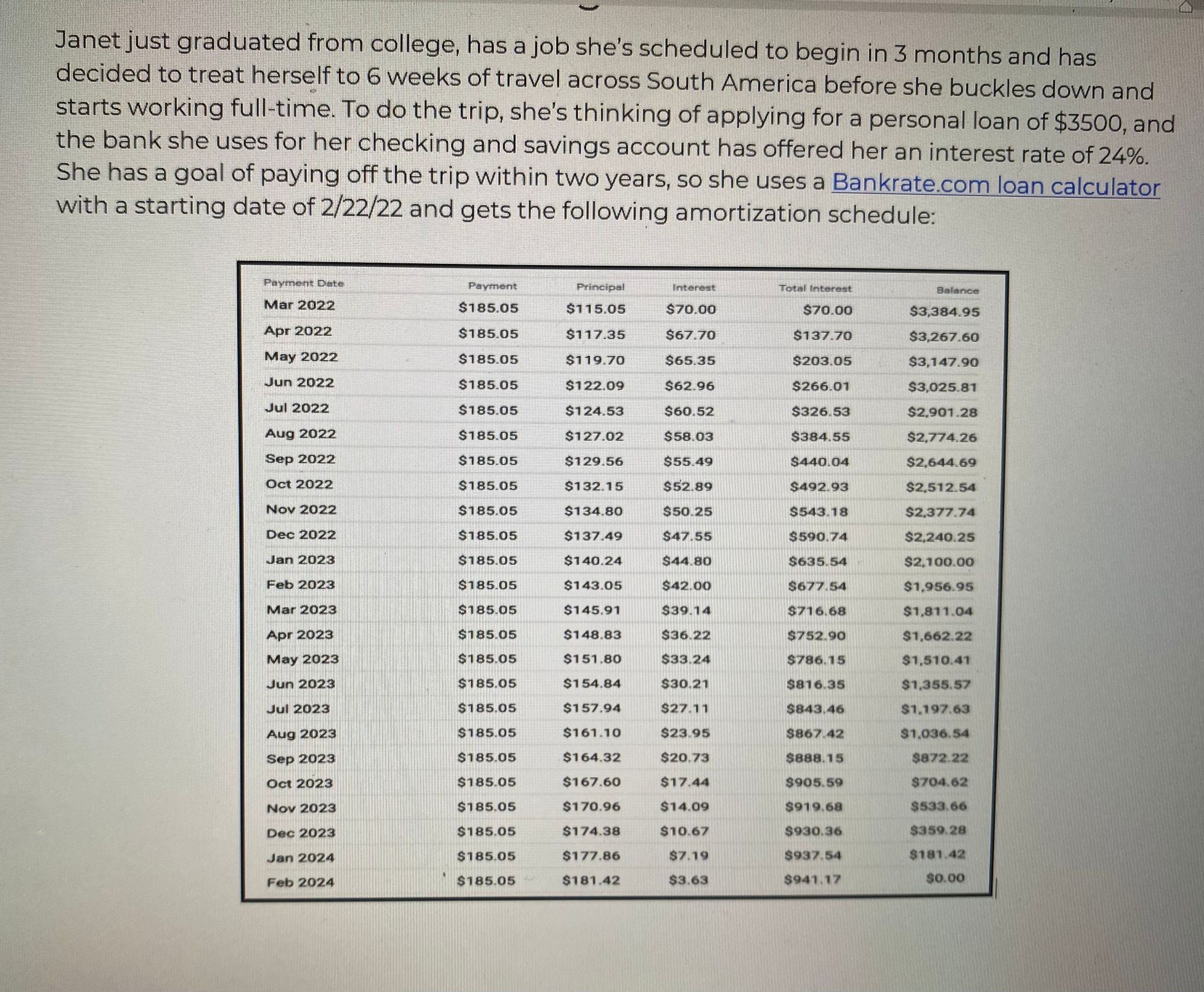

Janet just graduated from college, has a job she's scheduled to begin in 3 months and has decided to treat herself to 6 weeks of travel across South America before she buckles down and starts working full-time. To do the trip, she's thinking of applying for a personal loan of , and the bank she uses for her checking and savings account has offered her an interest rate of . She has a goal of paying off the trip within two years, so she uses a Bankrate.com loan calculator with a starting date of and gets the following amortization schedule: