Home /

Expert Answers /

Finance /

path-dependent-option-pricing-via-monte-carlo-simulation-consider-an-economy-with-a-stock-s-that-h-pa693

(Solved): Path-Dependent Option Pricing via Monte Carlo Simulation Consider an economy, with a stock S, that h ...

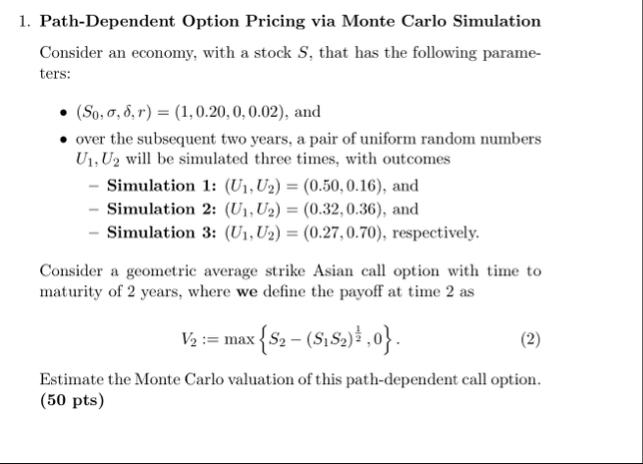

Path-Dependent Option Pricing via Monte Carlo Simulation Consider an economy, with a stock

S, that has the following parameters:

(S_(0),\sigma ,\delta ,r)=(1,0.20,0,0.02), and over the subsequent two years, a pair of uniform random numbers

U_(1),U_(2)will be simulated three times, with outcomes Simulation 1:

(U_(1),U_(2))=(0.50,0.16), and Simulation 2:

(U_(1),U_(2))=(0.32,0.36), and Simulation 3:

(U_(1),U_(2))=(0.27,0.70), respectively. Consider a geometric average strike Asian call option with time to maturity of 2 years, where we define the payoff at time 2 as

V_(2):=max{S_(2)-(S_(1)S_(2))^((1)/(2)),0}.Estimate the Monte Carlo valuation of this path-dependent call option. (50 pts)