(Solved): Phoenix Company reports the following fixed budget. It is based on an expected production and sales ...

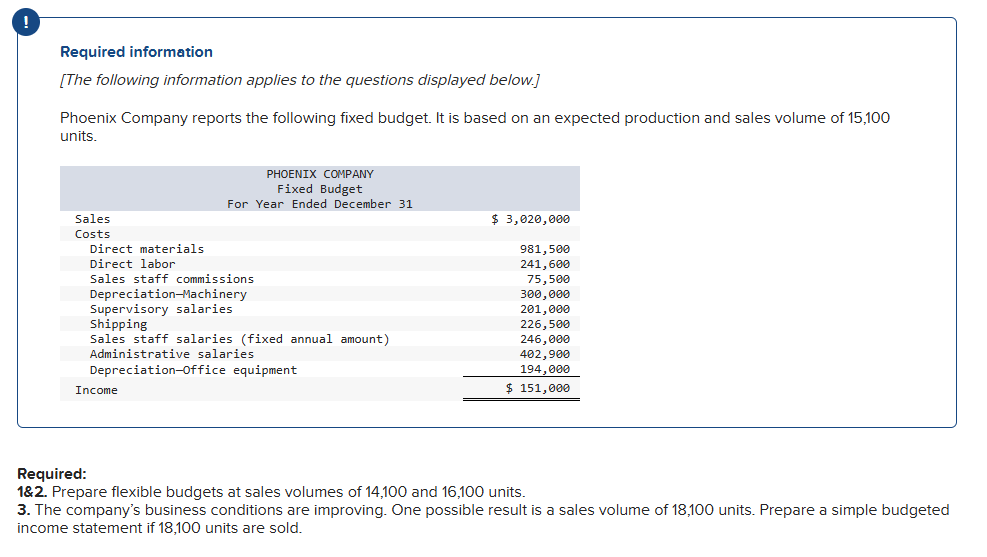

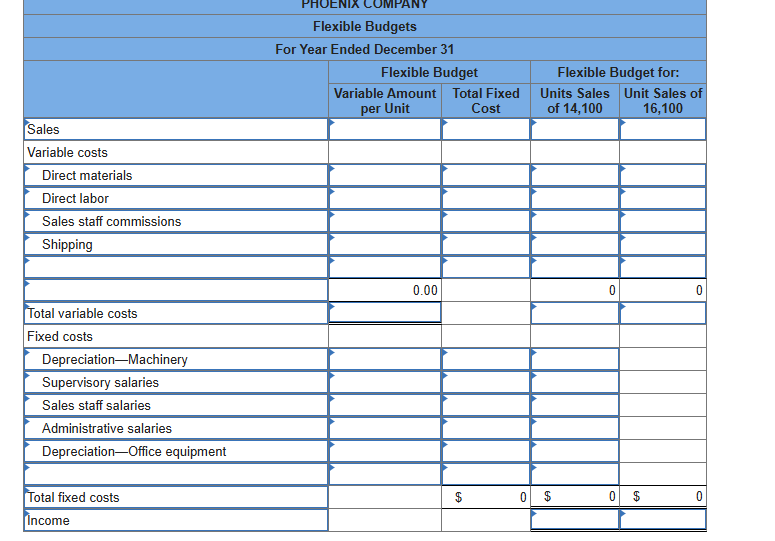

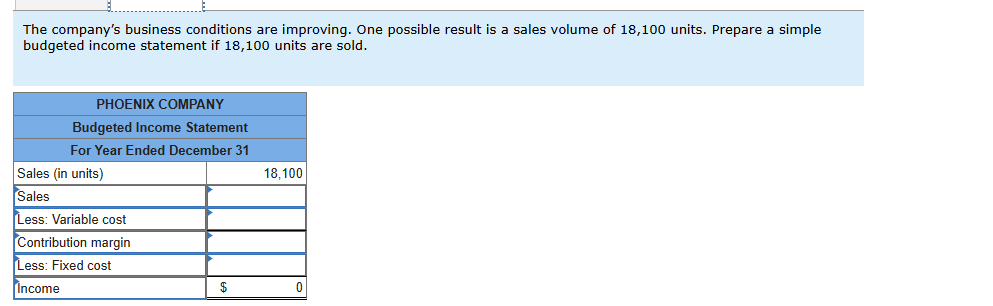

Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,100 units. PHOENIX COMPANYFixed BudgetFor Year Ended December 31Sales$ 3,020,000Costs Direct materials981,500Direct labor241,600Sales staff commissions75,500Depreciation—Machinery300,000Supervisory salaries201,000Shipping226,500Sales staff salaries (fixed annual amount)246,000Administrative salaries402,900Depreciation—Office equipment194,000Income$ 151,000 Required: 1&2. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. 3. The company’s business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a simple budgeted income statement if 18,100 units are sold. Required information [The following information applies to the questions displayed below.] Phoenix Company reports the following fixed budget. It is based on an expected production and sales volume of 15,100 units. Required: 1\&2. Prepare flexible budgets at sales volumes of 14,100 and 16,100 units. 3. The company's business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a simple budgeted income statement if 18,100 units are sold. \begin{tabular}{|c|c|c|c|c|} \hline & & & & \\ \hline \multicolumn{5}{|c|}{Flexible Budgets} \\ \hline \multicolumn{5}{|c|}{For Year Ended December 31} \\ \hline & \multicolumn{2}{|l|}{Flexible Budget} & \multicolumn{2}{|l|}{Flexible Budget for:} \\ \hline & Variable Amount per Unit & Total Fixed Cost & Units Sales of 14,100 & Unit Sales of 16,100 \\ \hline \multicolumn{5}{|l|}{Sales} \\ \hline \multicolumn{5}{|l|}{Variable costs} \\ \hline \multicolumn{5}{|l|}{Direct materials} \\ \hline \multicolumn{5}{|l|}{Direct labor} \\ \hline \multicolumn{5}{|l|}{Sales staff commissions} \\ \hline \multicolumn{5}{|l|}{Shipping} \\ \hline \multicolumn{5}{|l|}{} \\ \hline - & 0.00 & & 0 & 0 \\ \hline \multicolumn{5}{|l|}{Total variable costs} \\ \hline \multicolumn{5}{|l|}{Fixed costs} \\ \hline \multicolumn{5}{|l|}{Depreciation-Machinery} \\ \hline \multicolumn{5}{|l|}{Supervisory salaries} \\ \hline \multicolumn{5}{|l|}{Sales staff salaries} \\ \hline \multicolumn{5}{|l|}{Administrative salaries} \\ \hline \multicolumn{5}{|l|}{Depreciation-Office equipment} \\ \hline \multicolumn{5}{|l|}{} \\ \hline Total fixed costs & & \$ 0 & \$ 0 & \$ 0 \\ \hline İncome & & & & \\ \hline \end{tabular} The company's business conditions are improving. One possible result is a sales volume of 18,100 units. Prepare a simple budgeted income statement if 18,100 units are sold.