Home /

Expert Answers /

Statistics and Probability /

please-answer-and-type-each-question-not-write-down-on-another-paper-part-pa176

(Solved): Please answer and type each question (not write down on another paper) Part ...

Please answer and type each question (not write down on another paper)

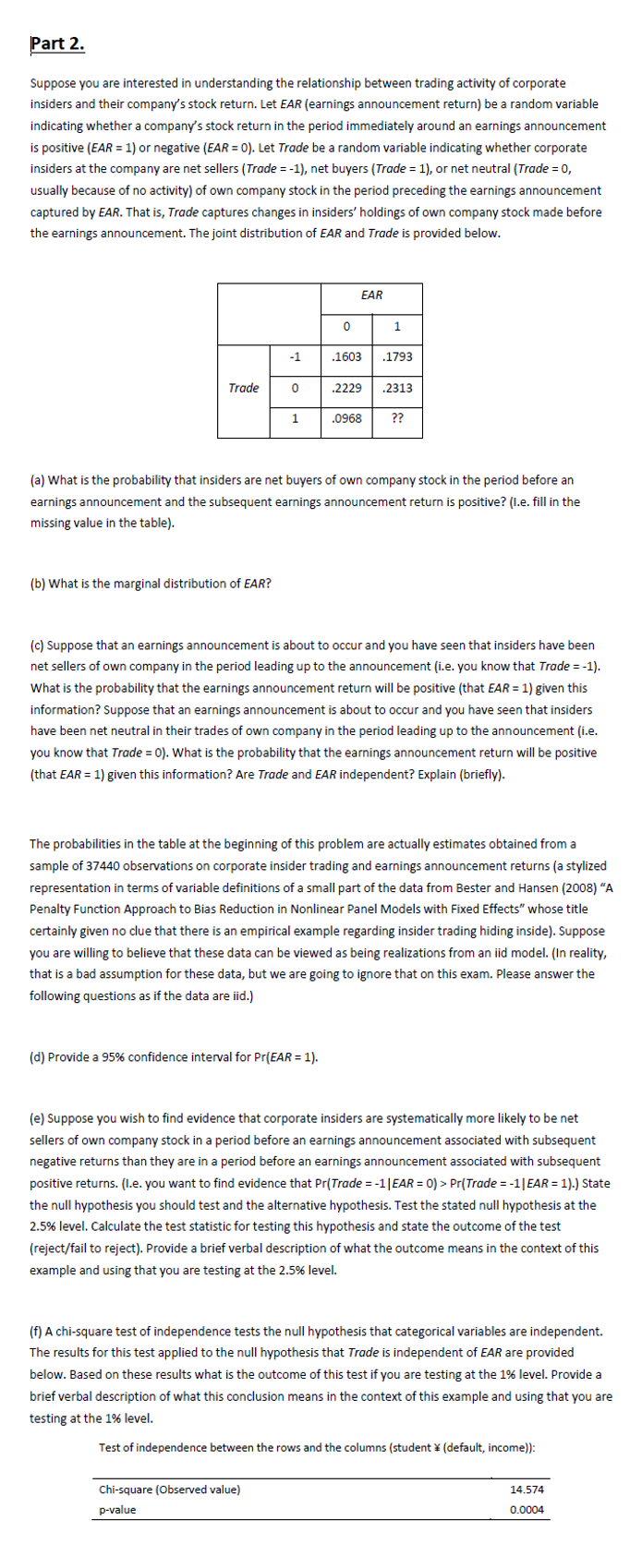

Part 2. Suppose you are interested in understanding the relationship between trading activity of corporate insiders and their company's stock return. Let EAR (earnings announcement return) be a random variable indicating whether a company's stock return in the period immediately around an earnings announcement is positive or negative . Let Trade be a random variable indicating whether corporate insiders at the company are net sellers (Trade , net buyers (Trade ), or net neutral (Trade , usually because of no activity) of own company stock in the period preceding the earnings announcement captured by EAR. That is, Trade captures changes in insiders' holdings of own company stock made before the earnings announcement. The joint distribution of EAR and Trade is provided below. (a) What is the probability that insiders are net buyers of own company stock in the period before an earnings announcement and the subsequent earnings announcement return is positive? (l.e. fill in the missing value in the table). (b) What is the marginal distribution of EAR? (c) Suppose that an earnings announcement is about to occur and you have seen that insiders have been net sellers of own company in the period leading up to the announcement (i.e. you know that Trade ). What is the probability that the earnings announcement return will be positive (that ) given this information? Suppose that an earnings announcement is about to occur and you have seen that insiders have been net neutral in their trades of own company in the period leading up to the announcement (i.e. you know that Trade = 0). What is the probability that the earnings announcement return will be positive (that EAR = 1) given this information? Are Trade and EAR independent? Explain (briefly). The probabilities in the table at the beginning of this problem are actually estimates obtained from a sample of 37440 observations on corporate insider trading and earnings announcement returns (a stylized representation in terms of variable definitions of a small part of the data from Bester and Hansen (2008) "A Penalty Function Approach to Bias Reduction in Nonlinear Panel Models with Fixed Effects" whose title certainly given no clue that there is an empirical example regarding insider trading hiding inside). Suppose you are willing to believe that these data can be viewed as being realizations from an iid model. (In reality, that is a bad assumption for these data, but we are going to ignore that on this exam. Please answer the following questions as if the data are iid.) (d) Provide a confidence interval for . (e) Suppose you wish to find evidence that corporate insiders are systematically more likely to be net sellers of own company stock in a period before an earnings announcement associated with subsequent negative returns than they are in a period before an earnings announcement associated with subsequent positive returns. (I.e. you want to find evidence that .) State the null hypothesis you should test and the alternative hypothesis. Test the stated null hypothesis at the 2.5\% level. Calculate the test statistic for testing this hypothesis and state the outcome of the test (reject/fail to reject). Provide a brief verbal description of what the outcome means in the context of this example and using that you are testing at the level. (f) A chi-square test of independence tests the null hypothesis that categorical variables are independent. The results for this test applied to the null hypothesis that Trade is independent of EAR are provided below. Based on these results what is the outcome of this test if you are testing at the level. Provide a brief verbal description of what this conclusion means in the context of this example and using that you are testing at the level. Test of independence between the rows and the columns (student (default, income)):