Home /

Expert Answers /

Accounting /

please-explain-in-detail-why-this-is-how-is-the-answer-400-as-34-taxable-income-34-the-question-is-pa402

(Solved): Please explain in detail why this is: How is the answer 400 as "taxable income"? The question is ...

Please explain in detail why this is:

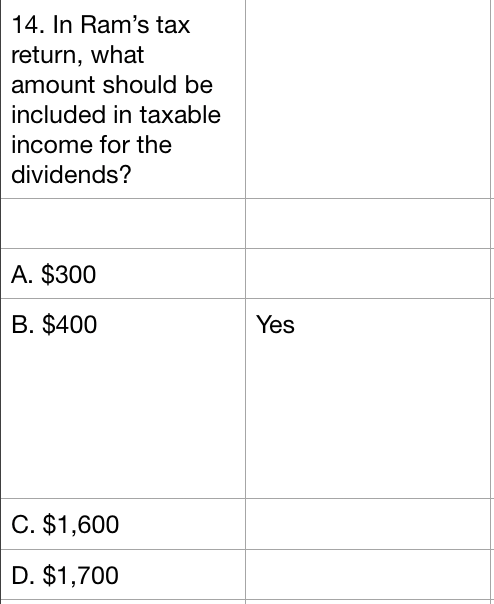

How is the answer 400 as "taxable income"?

The question is not asking for after-tax amounts or even taxed amounts, it specifically states "what is the taxable income" so how could this be?

Thank you for your help!

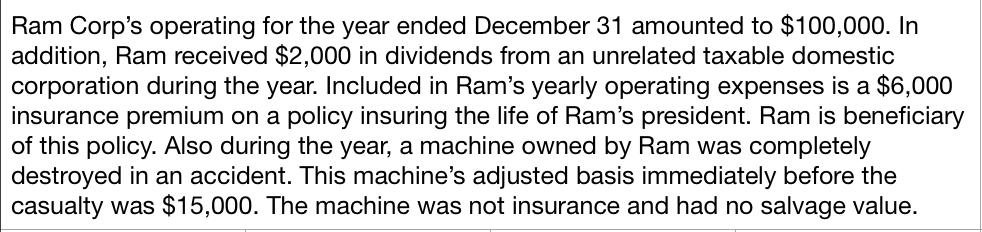

Ram Corp's operating for the year ended December 31 amounted to . In addition, Ram received in dividends from an unrelated taxable domestic corporation during the year. Included in Ram's yearly operating expenses is a insurance premium on a policy insuring the life of Ram's president. Ram is beneficiary of this policy. Also during the year, a machine owned by Ram was completely destroyed in an accident. This machine's adjusted basis immediately before the casualty was . The machine was not insurance and had no salvage value.

14. In Ram's tax return, what amount should be included in taxable income for the dividends? A. B. Yes C. D.

Expert Answer

To Arrive at Taxable Income the First and Foremost Step is Compute the Business Income from Ordinary Activities (Net income was $106000)Computation of