(Solved): PLEASE HELP Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, ...

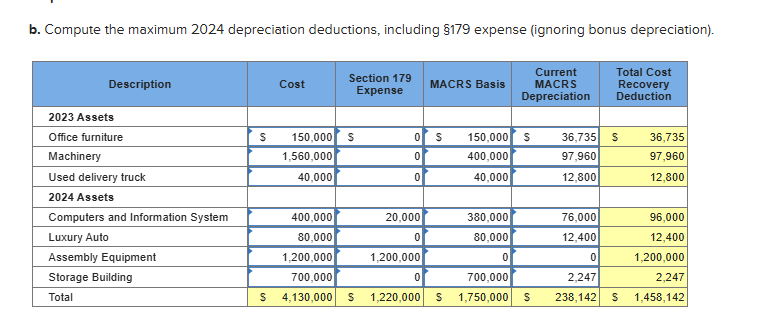

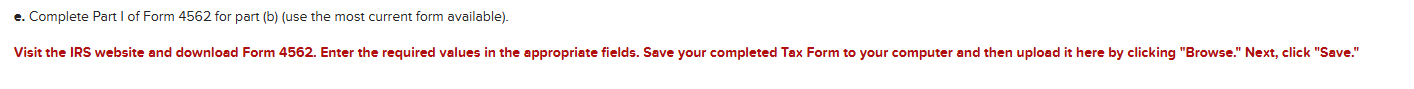

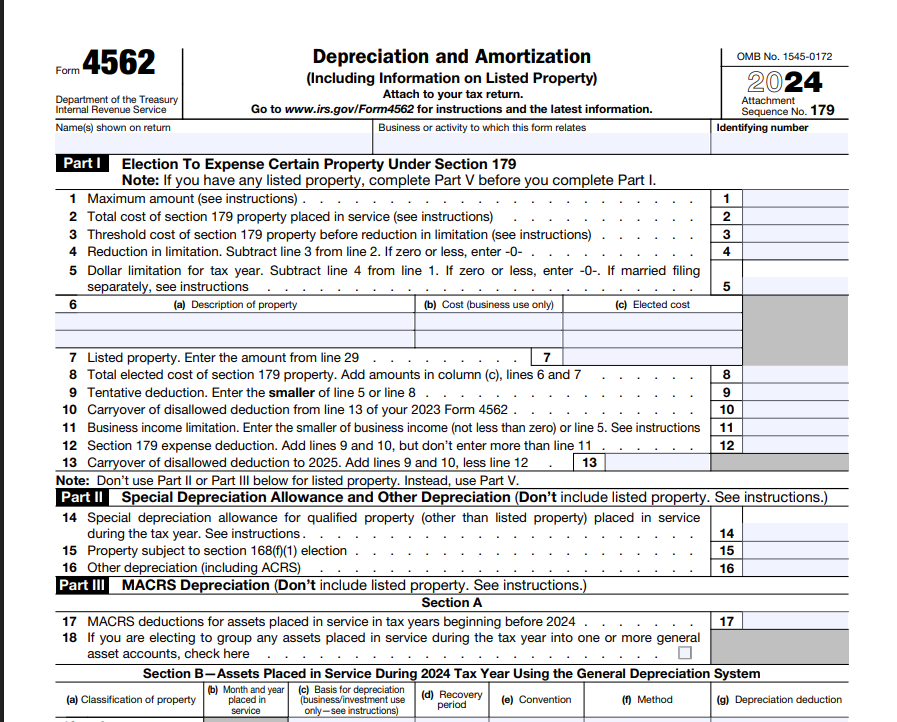

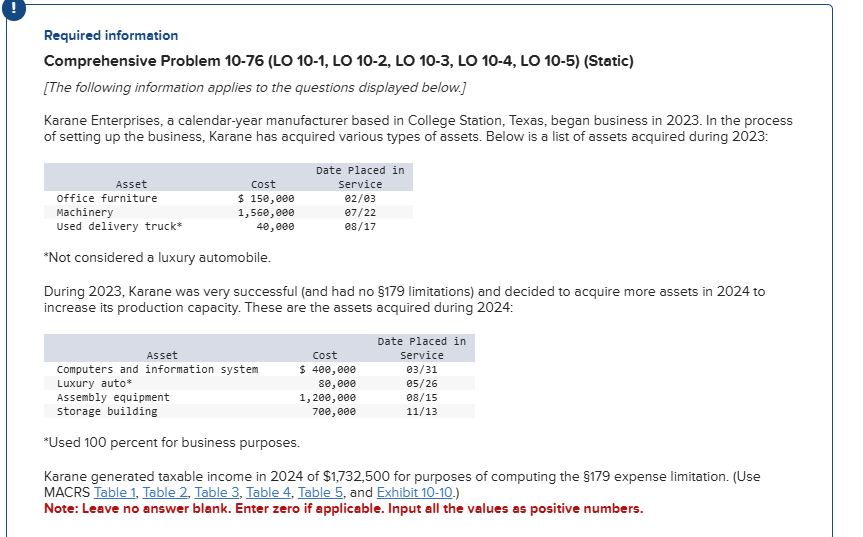

PLEASE HELP Required information Comprehensive Problem 10-76 (LO 10-1, LO 10-2, LO 10-3, LO 10-4, LO 10-5) (Static) [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2023. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2023: *Not considered a luxury automobile. During 2023, Karane was very successful (and had no \( \$ 179 \) limitations) and decided to acquire more assets in 2024 to increase its production capacity. These are the assets acquired during 2024: *Used 100 percent for business purposes. Karane generated taxable income in 2024 of \( \$ 1,732,500 \) for purposes of computing the \( \$ 179 \) expense limitation. (Use MACRS Table 1, Table 2, Table 3, Table 4, Table 5, and Exhibit 10-10.) Note: Leave no answer blank. Enter zero if applicable. Input all the values as positive numbers.