Home /

Expert Answers /

Finance /

please-include-1-steps-of-your-hedging-strategies-2-show-the-calculation-of-the-hedging-str-pa226

(Solved): PLEASE INCLUDE: 1. steps of your hedging strategies 2. show the calculation of the hedging str ...

PLEASE INCLUDE:

1. steps of your hedging strategies

2. show the calculation of the hedging strategies

3. discuss the advantages and disadvantages of each strategy.

THANK YOU SO MUCH !!

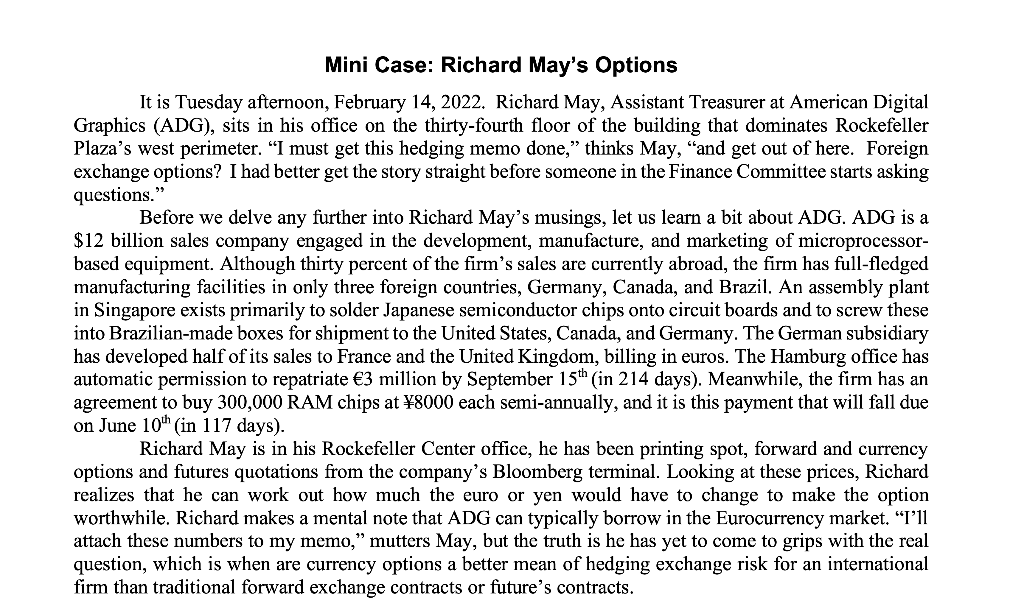

Mini Case: Richard May's Options It is Tuesday afternoon, February 14, 2022. Richard May, Assistant Treasurer at American Digital Graphics (ADG), sits in his office on the thirty-fourth floor of the building that dominates Rockefeller Plaza's west perimeter. "I must get this hedging memo done," thinks May, "and get out of here. Foreign exchange options? I had better get the story straight before someone in the Finance Committee starts asking questions." Before we delve any further into Richard May's musings, let us learn a bit about ADG. ADG is a billion sales company engaged in the development, manufacture, and marketing of microprocessorbased equipment. Although thirty percent of the firm's sales are currently abroad, the firm has full-fledged manufacturing facilities in only three foreign countries, Germany, Canada, and Brazil. An assembly plant in Singapore exists primarily to solder Japanese semiconductor chips onto circuit boards and to screw these into Brazilian-made boxes for shipment to the United States, Canada, and Germany. The German subsidiary has developed half of its sales to France and the United Kingdom, billing in euros. The Hamburg office has automatic permission to repatriate million by September (in 214 days). Meanwhile, the firm has an agreement to buy 300,000 RAM chips at each semi-annually, and it is this payment that will fall due on June (in 117 days). Richard May is in his Rockefeller Center office, he has been printing spot, forward and currency options and futures quotations from the company's Bloomberg terminal. Looking at these prices, Richard realizes that he can work out how much the euro or yen would have to change to make the option worthwhile. Richard makes a mental note that ADG can typically borrow in the Eurocurrency market. "I'll attach these numbers to my memo," mutters May, but the truth is he has yet to come to grips with the real question, which is when are currency options a better mean of hedging exchange risk for an international firm than traditional forward exchange contracts or future's contracts.

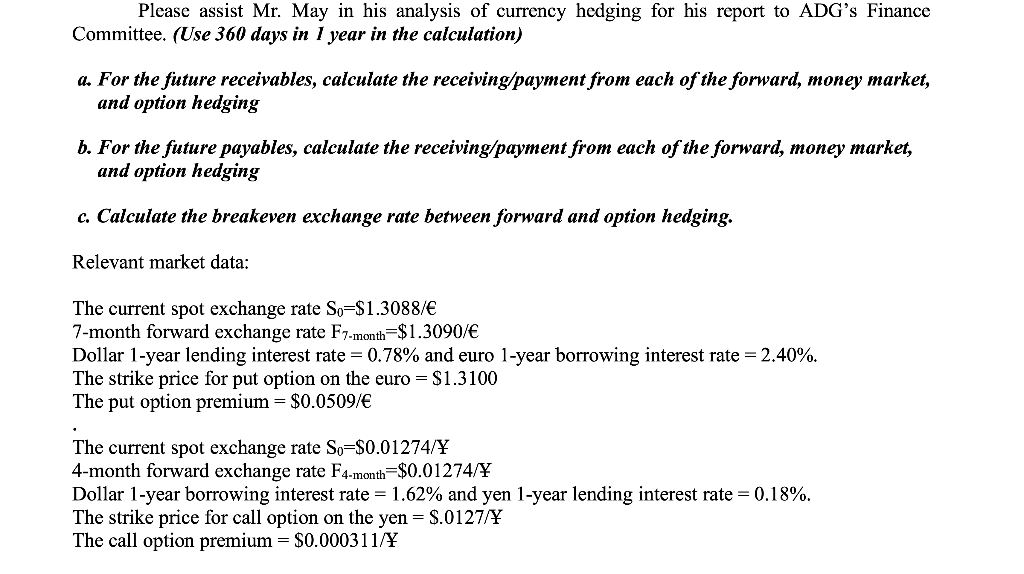

Please assist Mr. May in his analysis of currency hedging for his report to ADG's Finance Committee. (Use 360 days in 1 year in the calculation) a. For the future receivables, calculate the receiving/payment from each of the forward, money market, and option hedging b. For the future payables, calculate the receiving/payment from each of the forward, money market, and option hedging c. Calculate the breakeven exchange rate between forward and option hedging. Relevant market data: The current spot exchange rate 7-month forward exchange rate Dollar 1-year lending interest rate and euro 1-year borrowing interest rate . The strike price for put option on the euro The put option premium The current spot exchange rate 4-month forward exchange rate Dollar 1-year borrowing interest rate and yen 1-year lending interest rate . The strike price for call option on the yen The call option premium

Expert Answer

a. For the future receivables, the receiving/payment from each of the forward, money market, and option hedging are as follows: - Forward hedge: ADG has automatic permission to repatriate €3 million in 214 days. Based on the 7-month forward exchange rate of $1.3090/€, the expected amount of USD that ADG will receive in 214 days is: $1.3090/€ × €3,000,000 = $3,927,000 ADG can lock in this exchange rate by entering into a 7-month forward contract with a financial institution to sell €3,000,000 forward for USD. Assuming no transaction costs, the expected amount of USD that ADG will receive in 214 days from the forward contract is $3,927,000. - Money market hedge: ADG can borrow in the Eurocurrency market at an interest rate of 2.40%. Assuming no arbitrage opportunity, ADG can borrow €2,952,789 (i.e., the present value of €3,000,000 discounted at 2.40% for 214 days) and convert the proceeds to USD at the spot exchange rate of $1.3088/€. The expected amount of USD that ADG will receive in 214 days is: €2,952,789 × $1.3088/€ = $3,853,674 To repay the Eurocurrency loan, ADG needs to convert the USD proceeds to € at the future spot exchange rate, which is unknown. - Option hedge: ADG can buy a put option on the euro with a strike price of $1.3100 and a premium of $0.0509/€. By paying the premium, ADG has the right to sell €3,000,000 at $1.3100/€ in 214 days, regardless of the future spot exchange rate. If the future spot exchange rate is below $1.3100/€, ADG can exercise the option and receive $3,930,000 ($1.3100/€ × €3,000,000) for the €3,000,000 it sells. If the future spot exchange rate is above $1.3100/€, ADG can let the option expire and sell €3,000,000 at the higher spot exchange rate. Therefore, the worst-case scenario for ADG is that it loses the option premium of $0.0509/€.