Home /

Expert Answers /

Accounting /

pls-help-larned-corporation-recorded-the-following-transactions-for-the-just-completed-month-a-pa813

(Solved): pls help??! Larned Corporation recorded the following transactions for the just completed month. a. ...

pls help??!

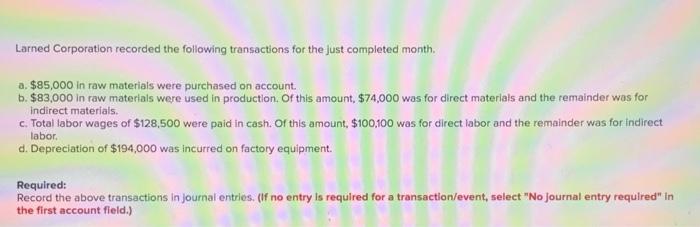

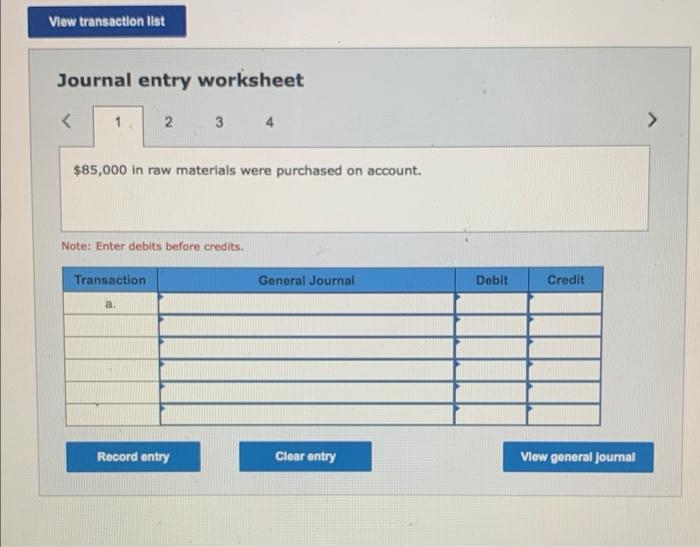

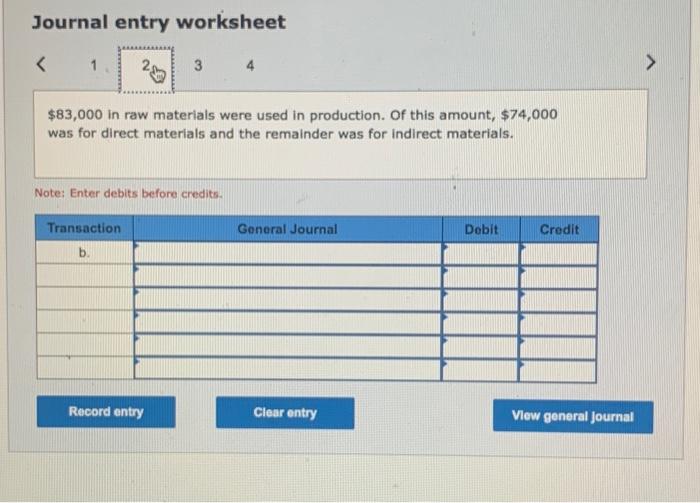

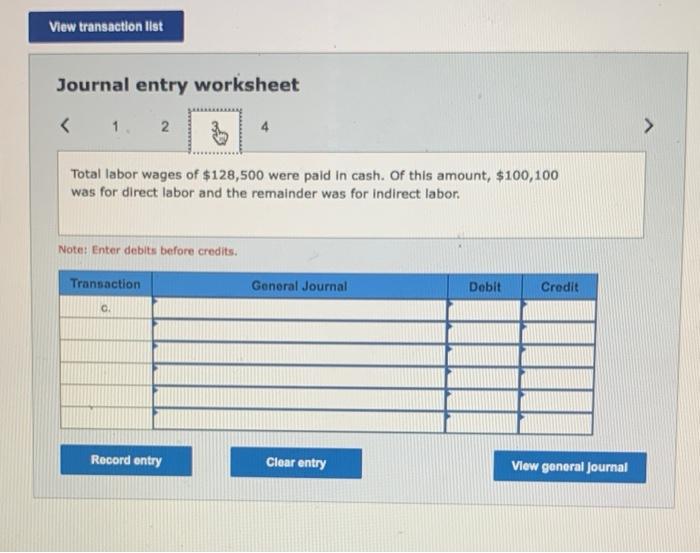

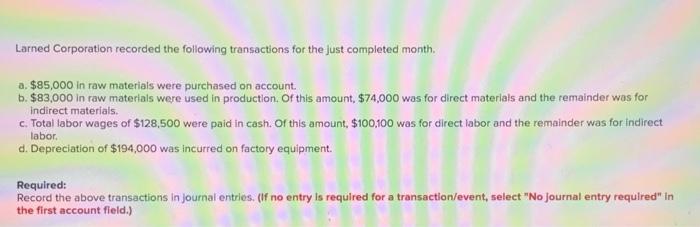

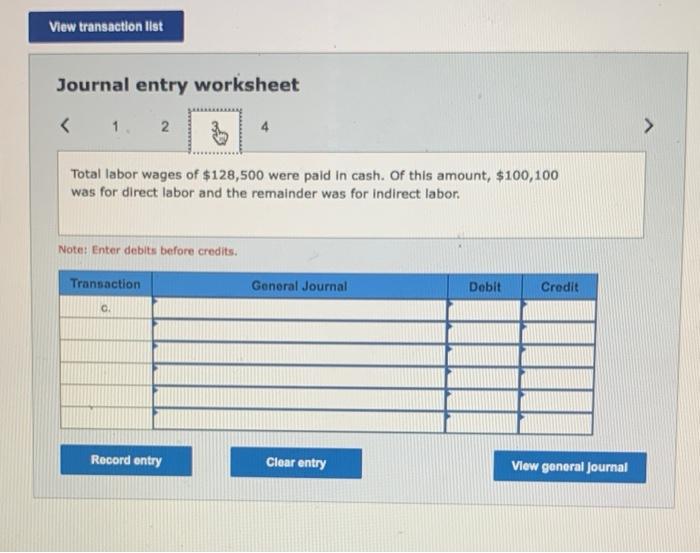

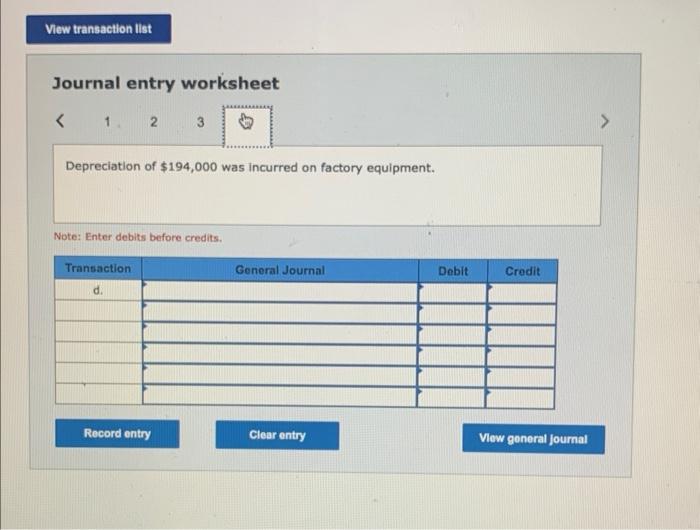

Larned Corporation recorded the following transactions for the just completed month. a. \( \$ 85,000 \) in raw materials were purchased on account. b. \( \$ 83,000 \) in raw materials were used in production. Of this amount, \( \$ 74,000 \) was for direct materials and the remainder was for indirect materials. c. Total labor wages of \( \$ 128,500 \) were paid in cash. Of this amount, \( \$ 100,100 \) was for direct labor and the remainder was for indirect labor. d. Depreciation of \( \$ 194,000 \) was incurred on factory equipment. Required: Record the above transactions in journal entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

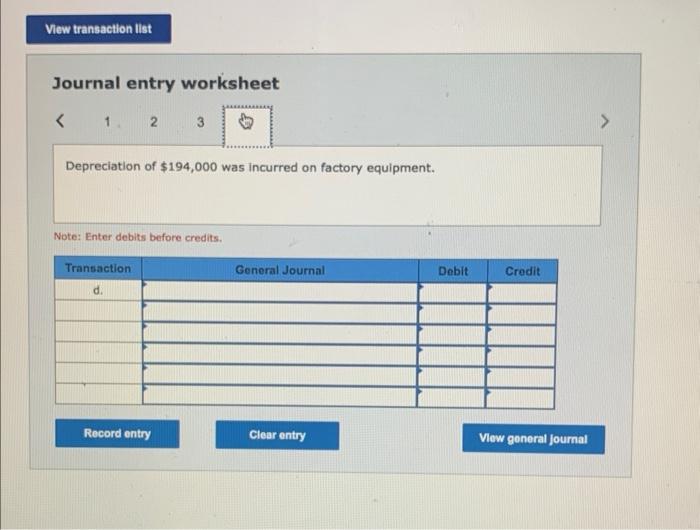

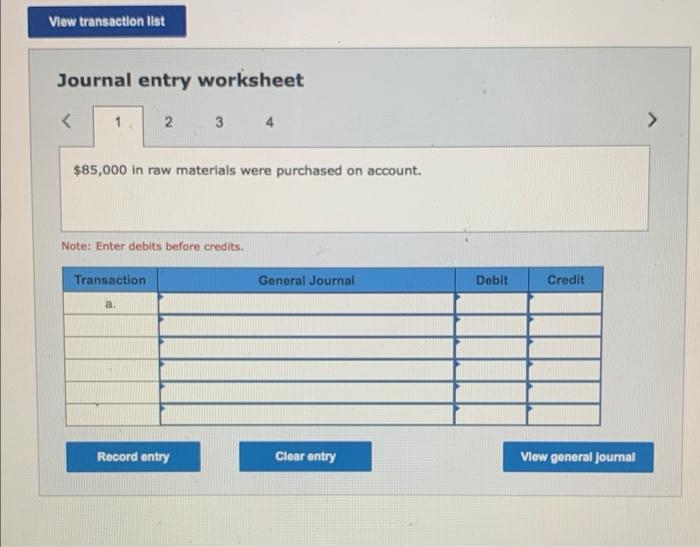

Journal entry worksheet 4 \( \$ 85,000 \) in raw materials were purchased on account. Note: Enter debits before credits.

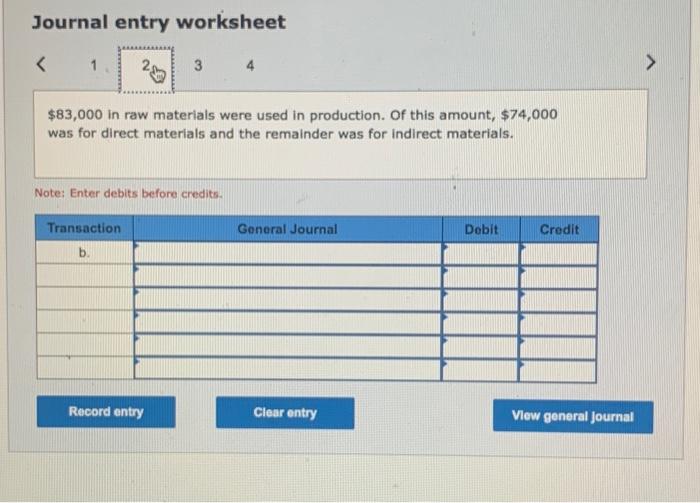

Journal entry worksheet \( \$ 83,000 \) in raw materials were used in production. Of this amount, \( \$ 74,000 \) was for direct materials and the remainder was for indirect materials. Note: Enter debits before credits.

Journal entry worksheet Total labor wages of \( \$ 128,500 \) were paid in cash. Of this amount, \( \$ 100,100 \) was for direct labor and the remainder was for indirect labor. Note: Enter debits before credits.

Journal entry worksheet Depreciation of \( \$ 194,000 \) was incurred on factory equipment. Note: Enter debits before credits.

Expert Answer

Solution: General Journal Debit Credit a Raw materials 85