Home /

Expert Answers /

Accounting /

pls-help-part-2-4-questions-2-points-each-during-the-year-2023-a-calendar-year-taxpayer-marvelo-pa306

(Solved): pls help Part 2 (4 questions: 2 points each) During the year 2023, a calendar-year taxpayer, Marvelo ...

pls help

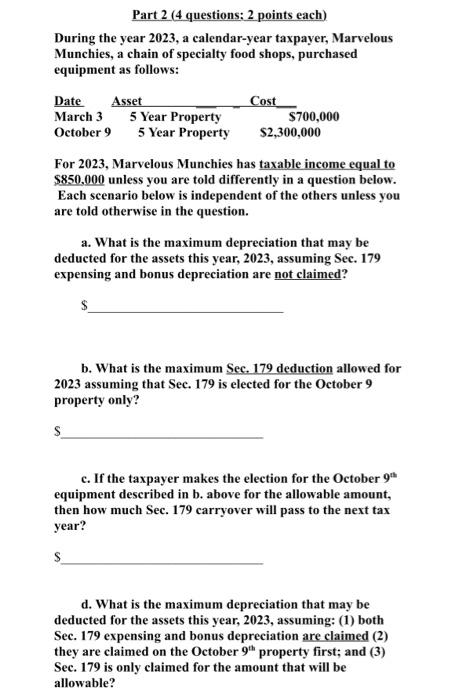

Part 2 (4 questions: 2 points each) During the year 2023, a calendar-year taxpayer, Marvelous Munchies, a chain of specialty food shops, purchased equipment as follows: For 2023, Marvelous Munchies has taxable income equal to unless you are told differently in a question below. Each scenario below is independent of the others unless you are told otherwise in the question. a. What is the maximum depreciation that may be deducted for the assets this year, 2023, assuming Sec. 179 expensing and bonus depreciation are not claimed? b. What is the maximum Sec. 179 deduction allowed for 2023 assuming that Sec. 179 is elected for the October 9 property only? c. If the taxpayer makes the election for the October equipment described in b. above for the allowable amount, then how much Sec. 179 carryover will pass to the next tax year? d. What is the maximum depreciation that may be deducted for the assets this year, 2023, assuming: (1) both Sec. 179 expensing and bonus depreciation are claimed (2) they are claimed on the October property first; and (3) Sec. 179 is only claimed for the amount that will be allowable?