(Solved): Presented below is information related to the pension plan of Sheridan Inc. for the year 2026. The s ...

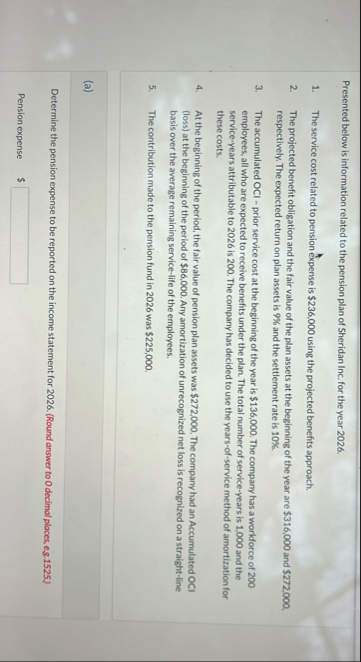

Presented below is information related to the pension plan of Sheridan Inc. for the year 2026. The service cost related to pension expense is

$236,000using the projected benefits approach. The projected benefit obligation and the fair value of the plan assets at the beginning of the year are

$316,000and

$272,000. respectively. The expected return on plan assets is

9%and the settlement rate is

10%. The accumulated OCI - prior service cost at the beginning of the year is

$136,000. The company has a workforce of 200 employees, all who are expected to receive benefits under the plan. The total number of service-years is 1,000 and the service-years attributable to 2026 is 200 . The company has decided to use the years-of-service method of amortization for these costs. At the beginning of the period, the fair value of pension plan assets was

$272,000. The company had an Accumulated OCl (loss) at the beginning of the period of

$86,000. Any amortization of unrecognized net loss is recognized on a straight-line basis over the average remaining service-life of the employees. The contribution made to the pension fund in 2026 was

$225,000. (a) Determine the pension expense to be reported on the income statement for 2026. (Round answer to 0 decimal places, eg. 1525) Pension expense

$

◻