(Solved): Problem 1: (20 points) Tom and Jerry are best friends and recently graduated from White Plains High ...

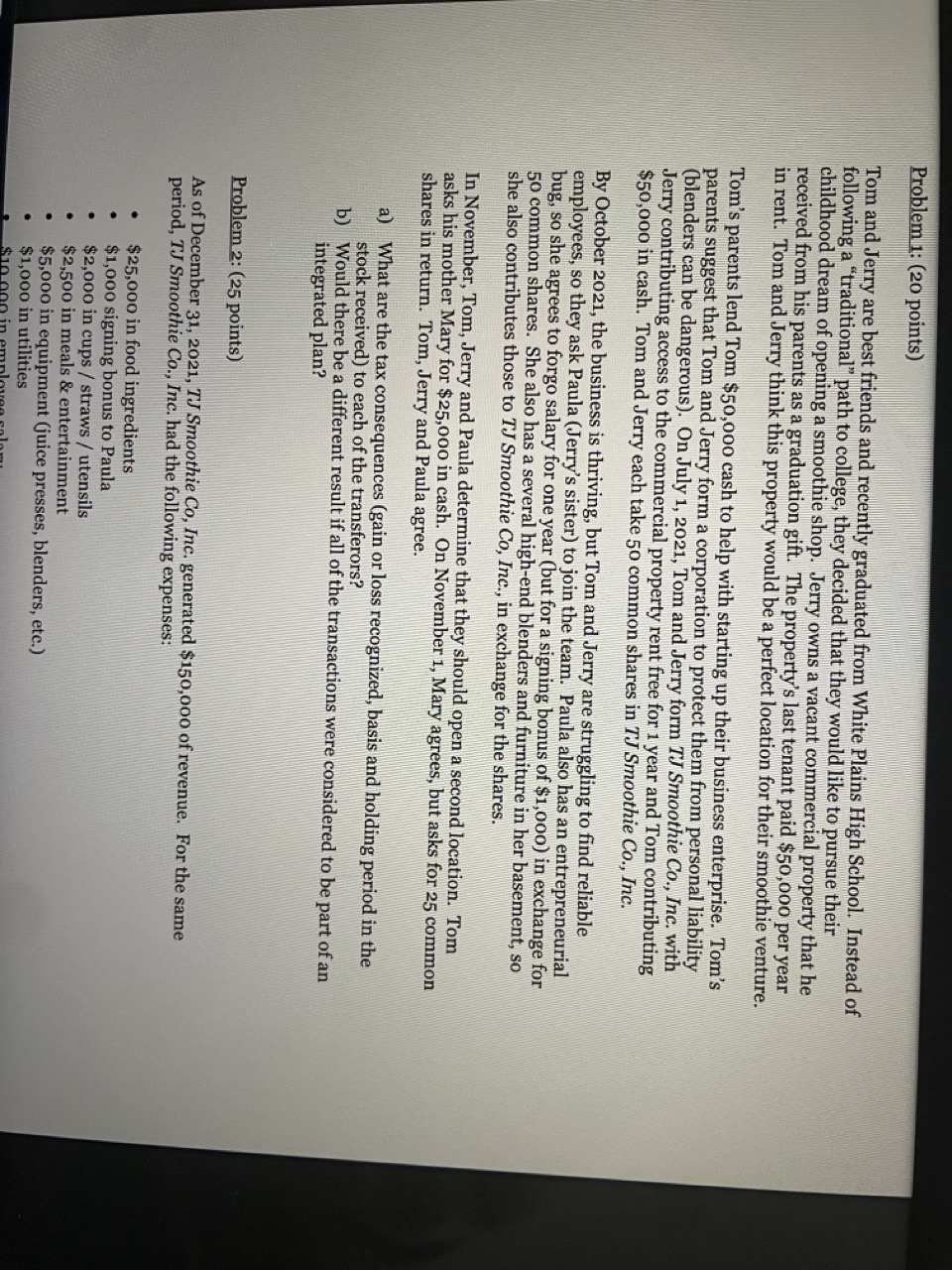

Problem 1: (20 points) Tom and Jerry are best friends and recently graduated from White Plains High School. Instead of following a "traditional" path to college, they decided that they would like to pursue their childhood dream of opening a smoothie shop. Jerry owns a vacant commercial property that he received from his parents as a graduation gift. The property's last tenant paid

$50,000per year in rent. Tom and Jerry think this property would be a perfect location for their smoothie venture. Tom's parents lend Tom

$50,000cash to help with starting up their business enterprise. Tom's parents suggest that Tom and Jerry form a corporation to protect them from personal liability (blenders can be dangerous). On July 1, 2021, Tom and Jerry form TJ Smoothie Co., Inc. with Jerry contributing access to the commercial property rent free for 1 year and Tom contributing

$50,000in cash. Tom and Jerry each take 50 common shares in TJ Smoothie Co., Inc. By October 2021, the business is thriving, but Tom and Jerry are struggling to find reliable employees, so they ask Paula (Jerry's sister) to join the team. Paula also has an entrepreneurial bug, so she agrees to forgo salary for one year (but for a signing bonus of

$1,000) in exchange for 50 common shares. She also has a several high-end blenders and furniture in her basement, so she also contributes those to TJ Smoothie Co, Inc., in exchange for the shares. In November, Tom, Jerry and Paula determine that they should open a second location. Tom asks his mother Mary for

$25,000in cash. On November 1, Mary agrees, but asks for 25 common shares in return. Tom, Jerry and Paula agree. a) What are the tax consequences (gain or loss recognized, basis and holding period in the stock received) to each of the transferors? b) Would there be a different result if all of the transactions were considered to be part of an integrated plan? PROBLEM 2 PLEASE As of December 31, 2021, TJ Smoothie Co, Inc. generated

$150,000of revenue. For the same period, TJ Smoothie Co., Inc. had the following expenses:

$25,000in food ingredients $1,000 signing bonus to Paula $2,000 in cups / straws / utensils

$2,500in meals & entertainment $5,000 in equipment (juice presses, blenders, etc.)

$1,000in utilities $10,000 in employee salary • $2,000 in tax exempt municipal bond interest • $3,000 federal income taxes paid a) Calculate TJ Smoothie Co., Inc.’s taxable income and E&P (highlighting E&P adjustments) for 2021 with the following assumptions: the equipment was placed into service during 2021, has a five-year life and the depreciation expense in 2021 under ACRS was $1,500. b) Assume TJ Smoothie’s E&P was a deficit of $25,000 in 2021 and positive $80,000 in 2022. TJ Smoothie makes no distributions in 2021, however makes distributions of $40,000 each to Tom, Jerry, and Paula, and $20,000 to Mary in 2022. What are the tax consequences to the individuals and to TJ Smoothie? Assume the shareholders basis in the stock of TJ Smoothie is equal to what was calculated in Problem 1 b) above. c) Assume for this question only that TJ Smoothie had no current E&P at the beginning of 2023, and had $10,000 accumulated E&P, and Tom purchased his TJ Smoothie stock five years ago and his basis is $5,000. Also assume that TJ Smoothie owned land with FMV of $40,000 and AB of $20,000. In 2o23, TJ Smoothie distributes the land to Tom. What are the consequences to Tom and TJ Smoothie?