Home /

Expert Answers /

Finance /

problem-2-put-call-parity-8-39-suppose-we-have-the-following-instruments-i-risk-free-bonds-ri-pa874

(Solved): Problem 2. (Put-call parity, 8') Suppose we have the following instruments: (i) risk-free bonds (ri ...

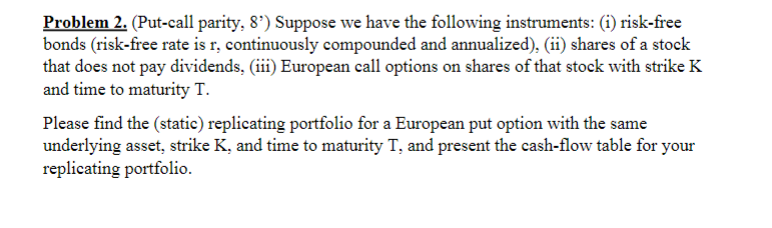

Problem 2. (Put-call parity, 8') Suppose we have the following instruments: (i) risk-free bonds (risk-free rate is r, continuously compounded and annualized), (ii) shares of a stock that does not pay dividends, (iii) European call options on shares of that stock with strike and time to maturity . Please find the (static) replicating portfolio for a European put option with the same underlying asset, strike , and time to maturity , and present the cash-flow table for your replicating portfolio.