(Solved): Problem 21-17 Lease vs Borrow You work for a nuclear research laboratory that is contemplating leasi ...

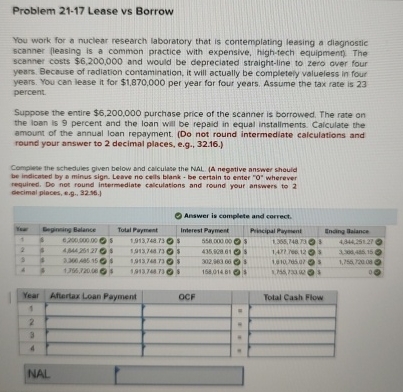

Problem 21-17 Lease vs Borrow You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner fleasing is a common practice with expensive, high-tech equipment). The scanner costs

$6,200,000and would be depreciated straight-line to zero over four years. Because of radiation contamination, it will actually be completely valueless in four years. You can lease it for

$1,870,000per year for four years. Assume the tax rate is 23 percent. Suppose the entire

$6,200,000purchase price of the scanner is borrowed. The rate on the loan is 9 percent and the loan will be repaid in equal installments. Calculate the amount of the annual loan repayment. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Complete the schedules given below and calculate the NAL. (A negative answer should be indicated by a minus sign. Learve no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32-96.1 Answer is complete and correct. \table[[Hse,Eegrning Ealance,Total Papment,Interest Payment,Principal Pwement,Inding Jaiance],[1,4,6,200,500,00,5,1,913,748.73,$,555,000,00,.,5,1.365,748.730,4,344,251,27 ©],[2,5,4.344.251.27,4,1,913.744.73,$,435,608.61,5,1.477.700.12,0,3,300-485,15,0],[3,4,3.360 .485 .15,4,1,913.744.73,5,302,869 06,3,1,810745.0?,0,1,756.720.00 (?)],[4,5,1.756,720.6e,4,1,913,748.73,8,158.014 .81,3,1.785 .730 .02,3,0.9]] \table[[Year,Aftertax Loan Payment,OCF,,Total Cash Flow],[1,

◻,,,],[2,,,,],[3,,,

◻,],[4,,,

◻,]] NAL.