Home /

Expert Answers /

Finance /

problem-5-1-a-price-level-adjusted-mortgage-plam-is-made-with-the-following-terms-amount-96-400-pa762

(Solved): Problem 5-1 A price level adjusted mortgage (PLAM) is made with the following terms: Amount =$96,400 ...

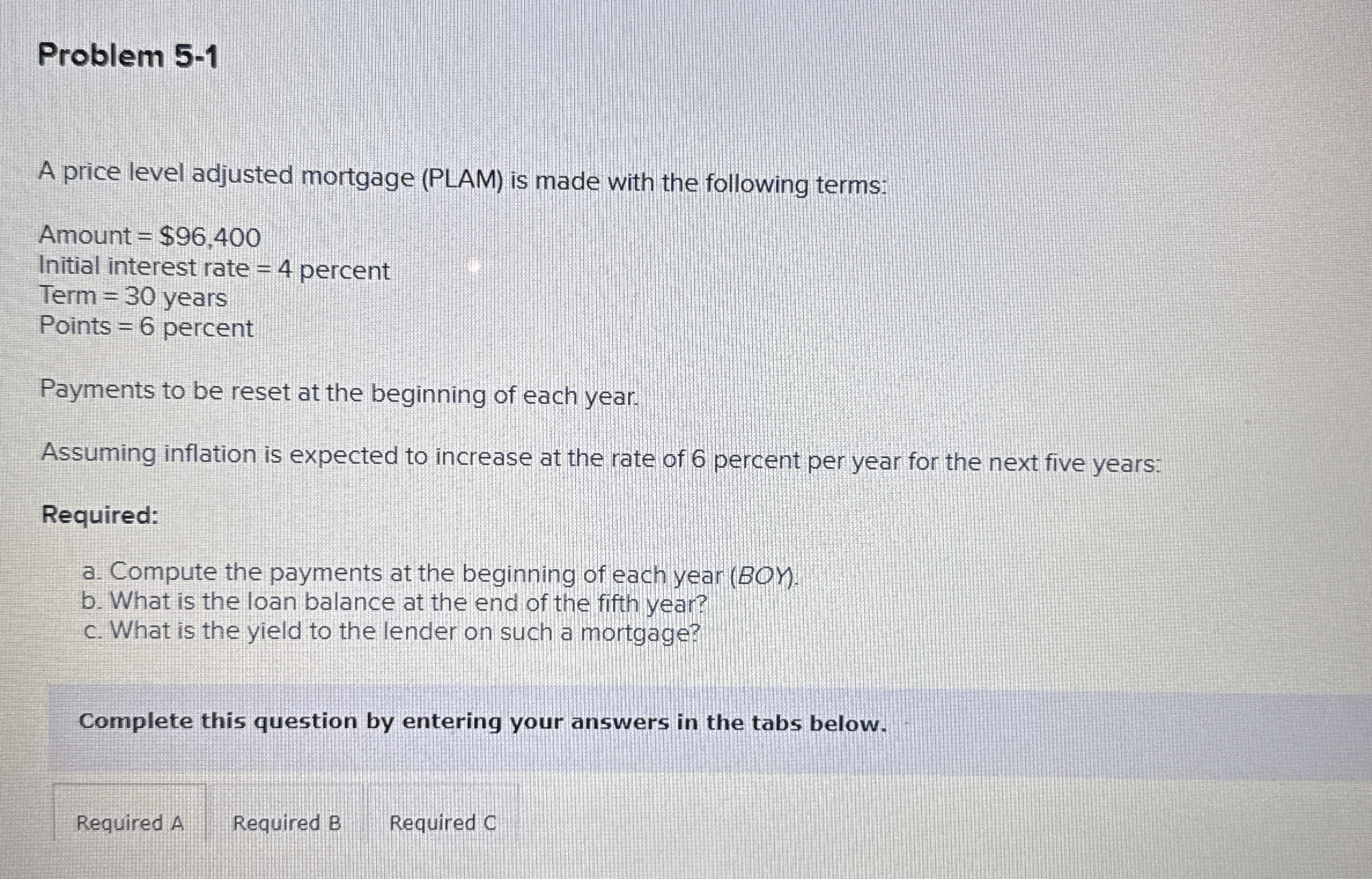

Problem 5-1 A price level adjusted mortgage (PLAM) is made with the following terms: Amount

=$96,400Initial interest rate

=4percent Term

=30years Points

=6percent Payments to be reset at the beginning of each year. Assuming inflation is expected to increase at the rate of 6 percent per year for the next five years: Required: a. Compute the payments at the beginning of each year (

BOY). b. What is the loan balance at the end of the fifth year? c. What is the yield to the lender on such a mortgage? Complete this question by entering your answers in the tabs below. Required A Required B Required C