(Solved): Q-4) Company X applies MOH to jobs on the basis of machine hours used. MOH costs are expected to tot ...

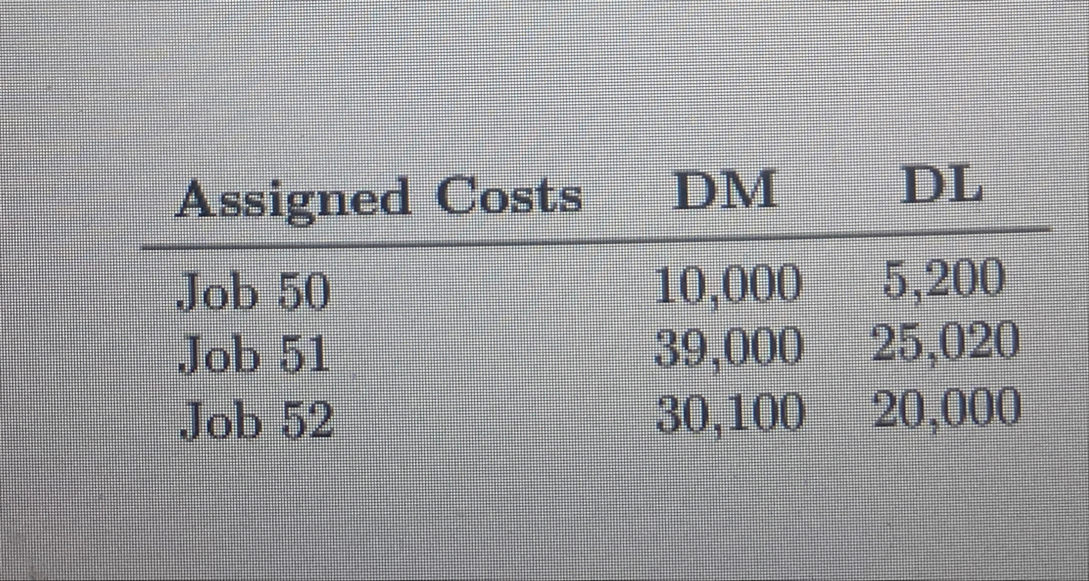

Q-4) Company X applies MOH to jobs on the basis of machine hours used. MOH costs are expected to total TL300,200 for the year, and machine usage is estimated at 121,000 hours. For the year, TL322,100 MOH costs are incurred and 130,020 machine hours are used. Calculate the amount of COGS adjustment at year-end. Use - if the COGS adjustment is credit. (e.g. if the required adjustment is debiting COGS by 100 , enter 100 . If if the required adjustment is crediting COGS by 100 , enter -100 .) Use below information for Questions 5 to 7: Company X uses a job cost system and applies overhead to production on the basis of direct labor cost. On January 1, 2018, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: DM of TL22,000, DL of TL11,600, and MOH of TL15,001. As of January 1, Job 49 had been completed at a cost of TL85,002 and was part of finished goods inventory. There was a TL13,500 balance in the raw materials inventory account. During the month of January, Company X began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for TL122,600 and TL158,020, respectively. Following additional events occurred during the month: Purchased additional raw materials of TL95,002 on account. Incurred factory labor costs of TL64,600 exclusive of payroll taxes. Payroll taxes amounted to TL16,010. Incurred indirect materials of TL17,000, and indirect labor of TL20,001 Depreciation on factory equipment totalled to TL12,000 Other factory expenses on account were TL12,000 During the month, Company X assigned following costs to respective jobs as follows: Company X estimates total manufacturing overhead costs of TL882,000, direct labor costs of TL700,010 and direct labor hours 20,060 for the year. Ara 8

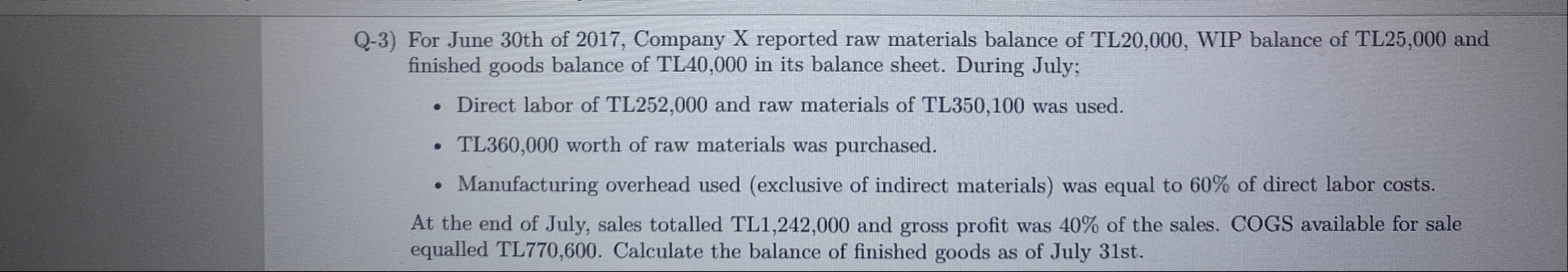

21\deg CÇok bulutluQ-3) For June 30th of 2017, Company X reported raw materials balance of TL20,000, WIP balance of TL25,000 and finished goods balance of TL40,000 in its balance sheet. During July; Direct labor of TL252,000 and raw materials of TL350,100 was used. TL360,000 worth of raw materials was purchased. Manufacturing overhead used (exclusive of indirect materials) was equal to

60%of direct labor costs. At the end of July, sales totalled TL1,242,000 and gross profit was

40%of the sales. COGS available for sale equalled TL770,600. Calculate the balance of finished goods as of July 31st. \table[[Assigned Costs,DM,DL],[Job 50,10,000,5,200],[Job 51,39,000,25,020],[Job 52,30,100,20,000]]