Home /

Expert Answers /

Accounting /

question-15-p-acquired-100-shares-of-s-on-jan-1-2018-for-200-000-on-that-date-s-reported-a-co-pa211

(Solved): Question 15 P acquired 100\% shares of S on Jan 1, 2018, for $200,000. On that date S reported a co ...

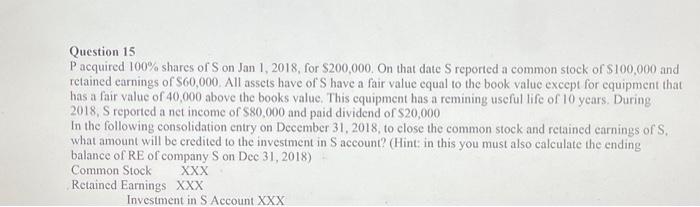

Question 15 P acquired 100\% shares of S on Jan 1, 2018, for . On that date S reported a common stock of and retained earnings of . All assets have of have a fair value equal to the book value except for equipment that has a fair value of 40,000 above the books value. This cquipment has a remining useful life of 10 years. During reported a net income of and paid dividend of In the following consolidation entry on December 31, 2018, to close the common stock and retained earnings of , what amount will be credited to the investment in account? (Hint: in this you must also calculate the ending balance of RE of company S on Dec 31, 2018) Common Stock XXX Retained Earnings XXX Investment in S Account XXX

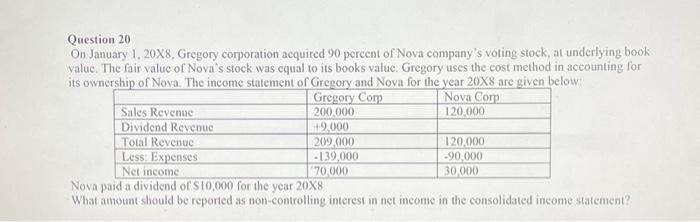

Question 20 On January 1, 20X8, Gregory corporation acquired 90 percent of Nova company's voting stock, at underlying book value. The fair value of Nova's stock was cqual to its books value. Gregory uses the cost method in accounting for its ownershin of Nova. The ineome statement of Greeorv and Nova for the vear are given below: Nova paid a dividend of for the year What amount should be reported as non-controlling interest in net income in the consolidated income statement?