Home /

Expert Answers /

Economics /

question-18-4-16-pts-suppose-that-we-are-in-the-salt-market-and-the-government-implements-an-excise-pa633

(Solved): Question 18 4.16 pts Suppose that we are in the salt market and the government implements an excise ...

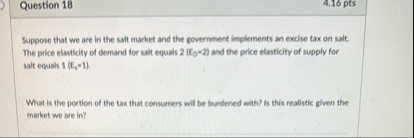

Question 18 4.16 pts Suppose that we are in the salt market and the government implements an excise tax on salt. The price elasticity of demand for salt equals

2(E_(0)-2)and the price elasticity of supply for salt equals 1 (

L_(4)=1). What is the portion of the tax that consumers wil be burdened with? Is this realistic given the maket we are in?