(Solved): QUESTION 3 Note: Answer this question individually in the Assignment 2 Answer Booklet. Gripe Ltd ask ...

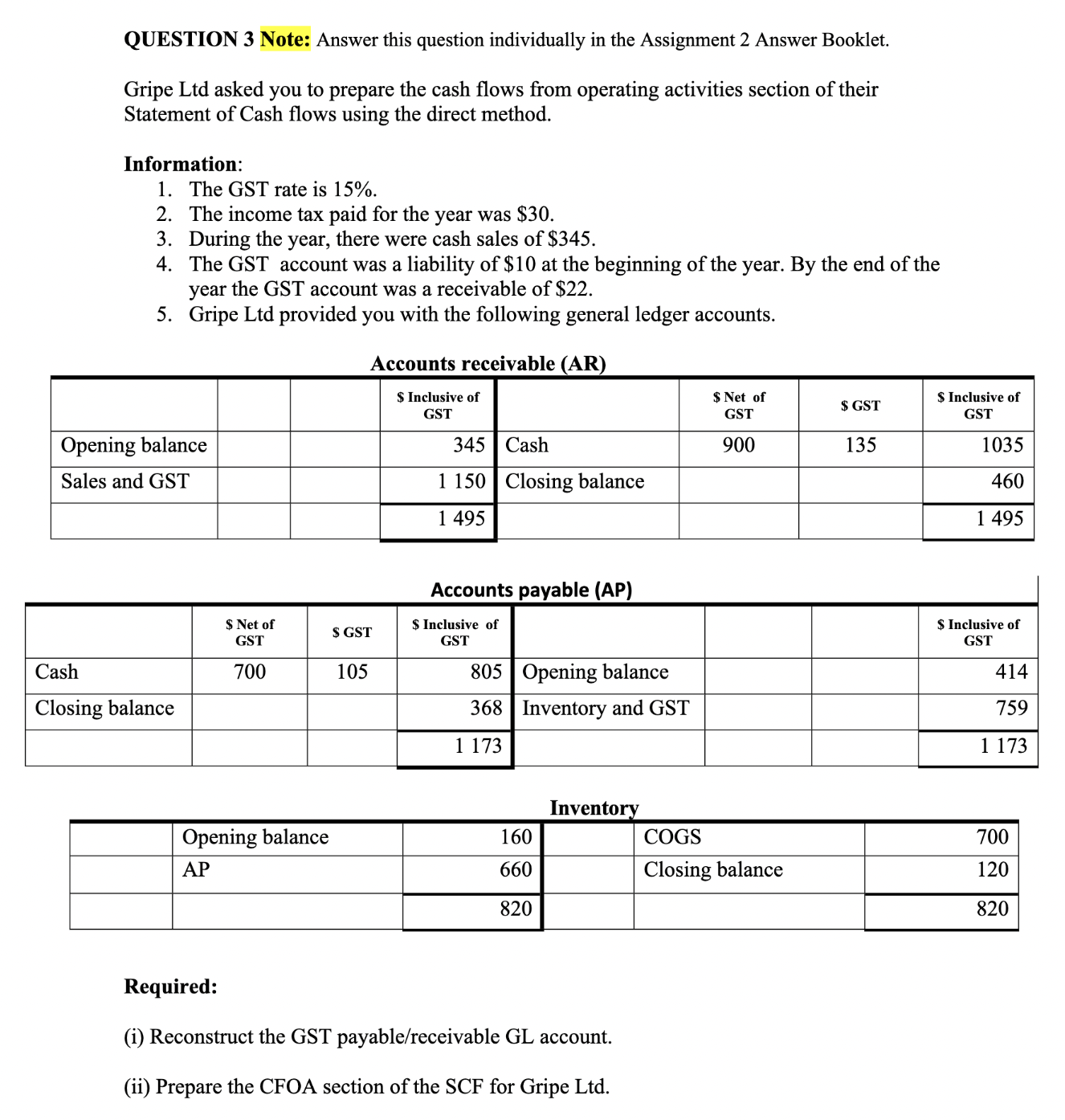

QUESTION 3 Note: Answer this question individually in the Assignment 2 Answer Booklet. Gripe Ltd asked you to prepare the cash flows from operating activities section of their Statement of Cash flows using the direct method. Information: 1. The GST rate is \( 15 \% \). 2. The income tax paid for the year was \( \$ 30 \). 3. During the year, there were cash sales of \( \$ 345 \). 4. The GST account was a liability of \( \$ 10 \) at the beginning of the year. By the end of the year the GST account was a receivable of \( \$ 22 \). 5. Gripe Ltd provided you with the following general ledger accounts. Accounts receivable (AR) Accounts payable (AP) Inventory Required: (i) Reconstruct the GST payable/receivable GL account. (ii) Prepare the CFOA section of the SCF for Gripe Ltd.