Home /

Expert Answers /

Accounting /

question-5-of-20-which-of-the-following-will-be-required-to-pay-a-penalty-for-excess-contributionto-pa847

(Solved): Question 5 of 20. Which of the following will be required to pay a penalty for excess contributionto ...

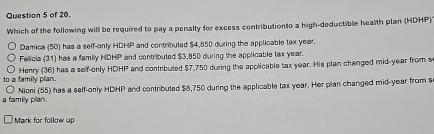

Question 5 of 20. Which of the following will be required to pay a penalty for excess contributionto a high-deductible healith plan (HDHP) Damica ( 50 ) has a self-only HDHP and contributed

$4,850during the applicable tax year. Felicia (31) has a family HDHP and contributed

$3,850during the applicable tax year. Henry (36) has a seff-only HDHP and contributed

$7.750during the applicable tax year. His plan changed mid-year from si to a family plan.

◻Nioni ( 55 ) has a self-only HDHP and cantrbuted

$8,750during the applicable tax year. Her plan changed mid-year from 51 a family plan.

◻Mark for follow up