(Solved): Question 6 Select the statement that is most correct. The constant growth model used for evaluating ...

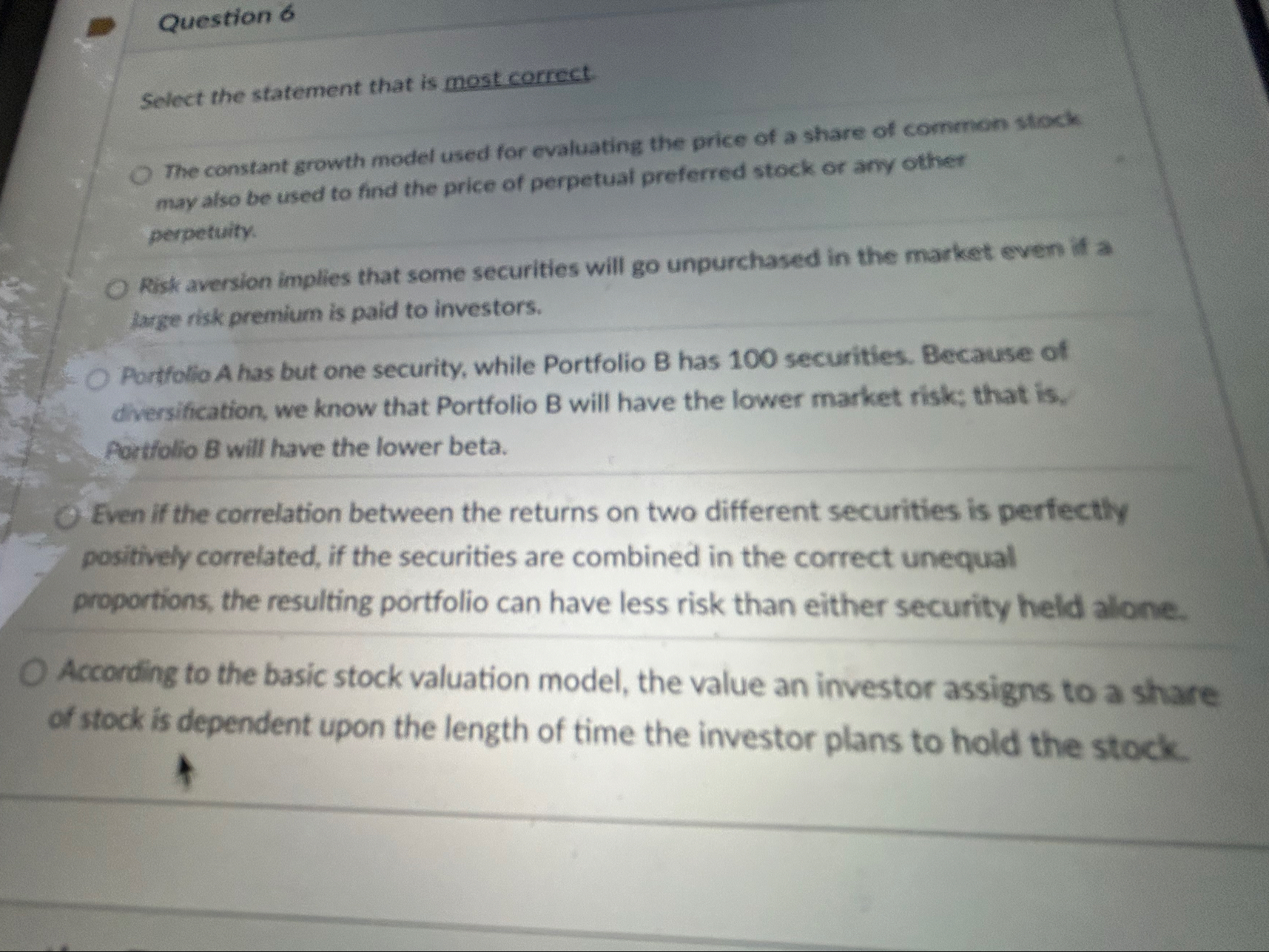

Question 6 Select the statement that is most correct. The constant growth model used for evaluating the price of a share of common stock may also be used to find the price of perpetual preferred stock or amy other perpetuity. Risk aversion implies that some securities will go unpurchased in the market even if a large risk premium is paid to investors. Portlolio A has but one security, while Portfolio B has 100 securities. Because of diversification, we know that Portfolio B will have the lower market risk; that is. Aortfolio 8 will have the lower beta. Even if the correlation between the returns on two different securities is perfectly novitively correlated, if the securities are combined in the correct unequal proportions, the resulting portfolio can have less risk than either security held alone. According to the basic stock valuation model, the value an investor assigns to a share of stock is dependent upon the length of time the investor plans to hold the stock.