Home /

Expert Answers /

Economics /

question-7-imagine-that-in-a-given-point-in-time-t-we-observe-the-following-yields-i1t-2-12-pa198

(Solved): Question 7 Imagine that in a given point in time, t, we observe the following yields: i1t - 2%, 12 ...

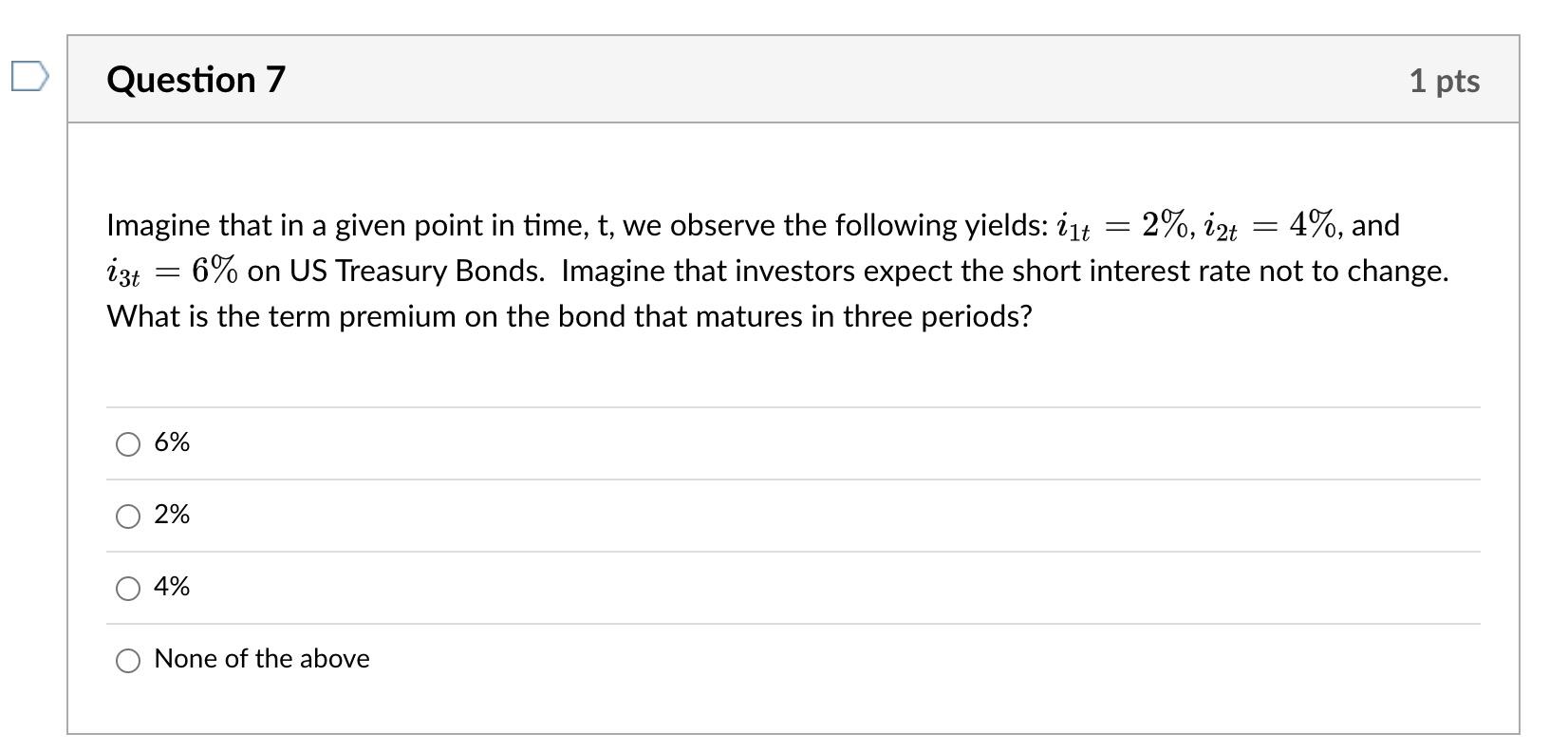

Question 7 Imagine that in a given point in time, t, we observe the following yields: i1t - 2%, 12t = 4%, and izt = 6% on US Treasury Bonds. Imagine that investors expect the short interest rate not to change. What is the term premium on the bond that matures in three periods? 6% 2% 4% None of the above 1 pts

Expert Answer

Answer : The term premium on the bond that matures in three periods is 4%. Term premium = 6% - 2% = 4% The term premium is the difference in yield between a longer-term bond and a shorter-term bond. In this case, the yield on the three-period bond is