(Solved): \ Required Information [The following information applies to the questions displayed below.] Leda. I ...

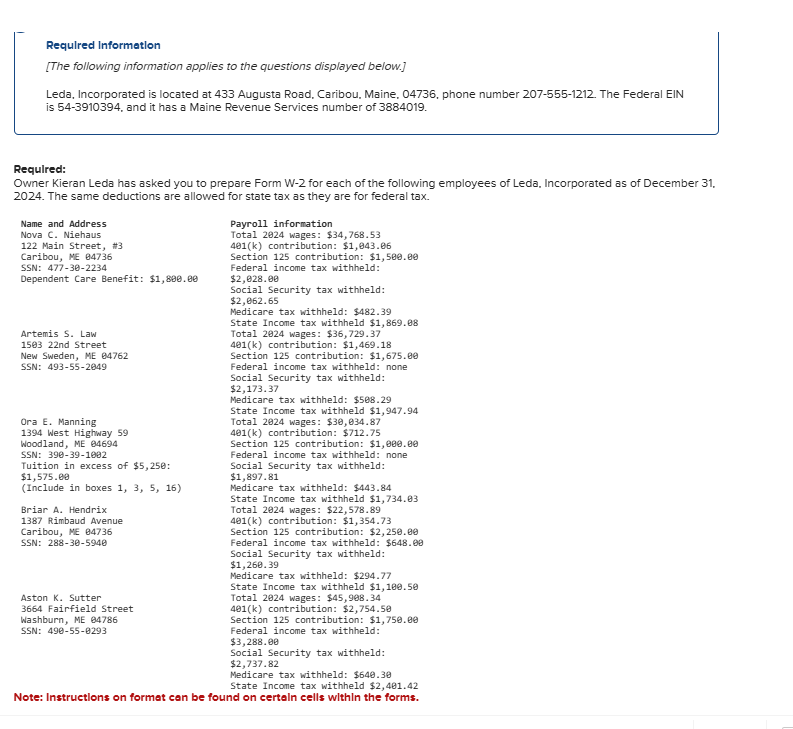

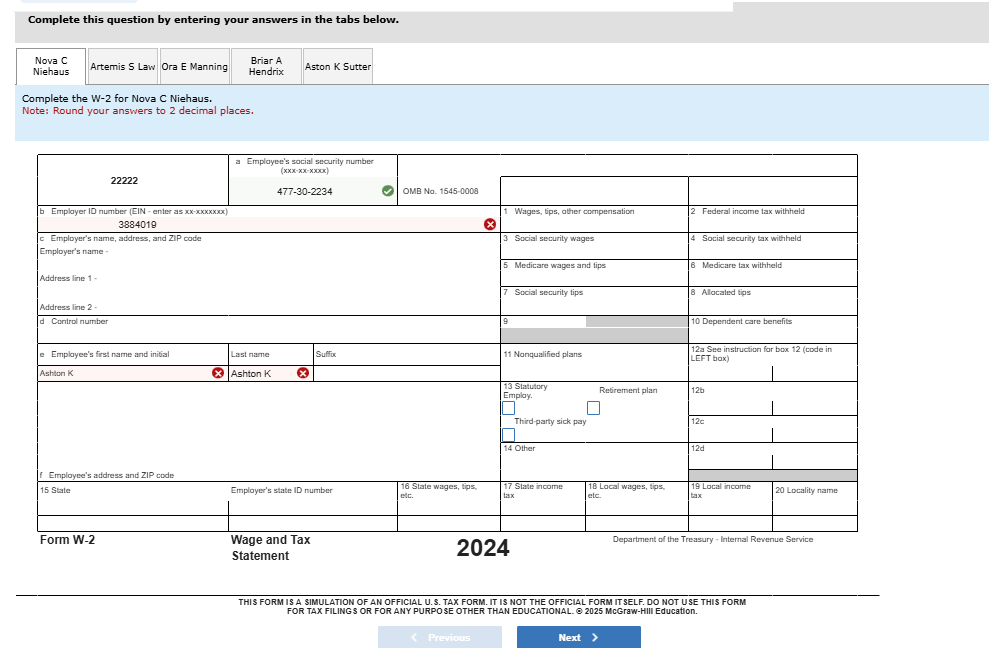

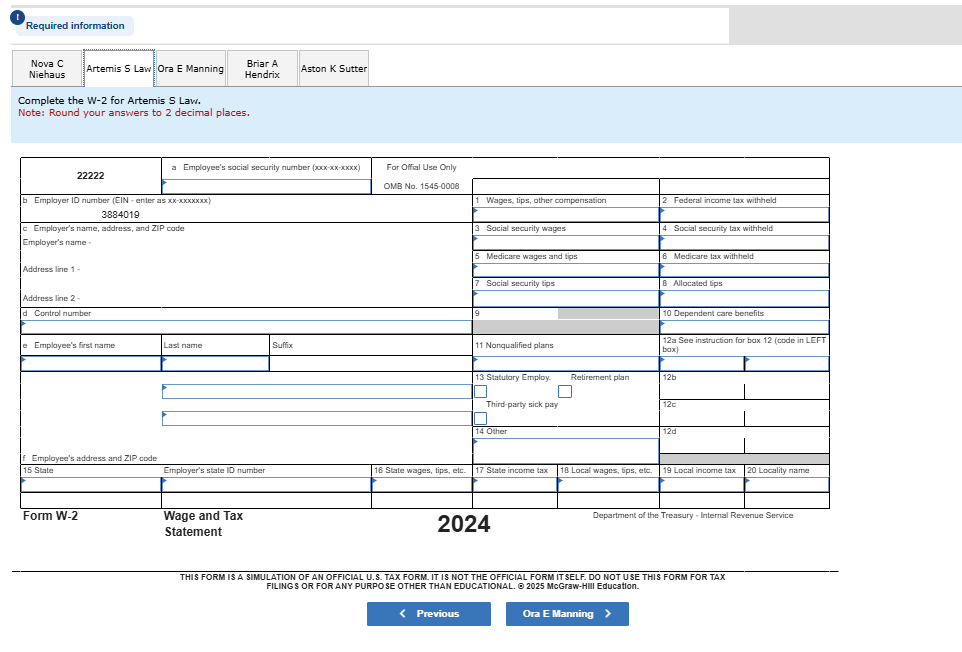

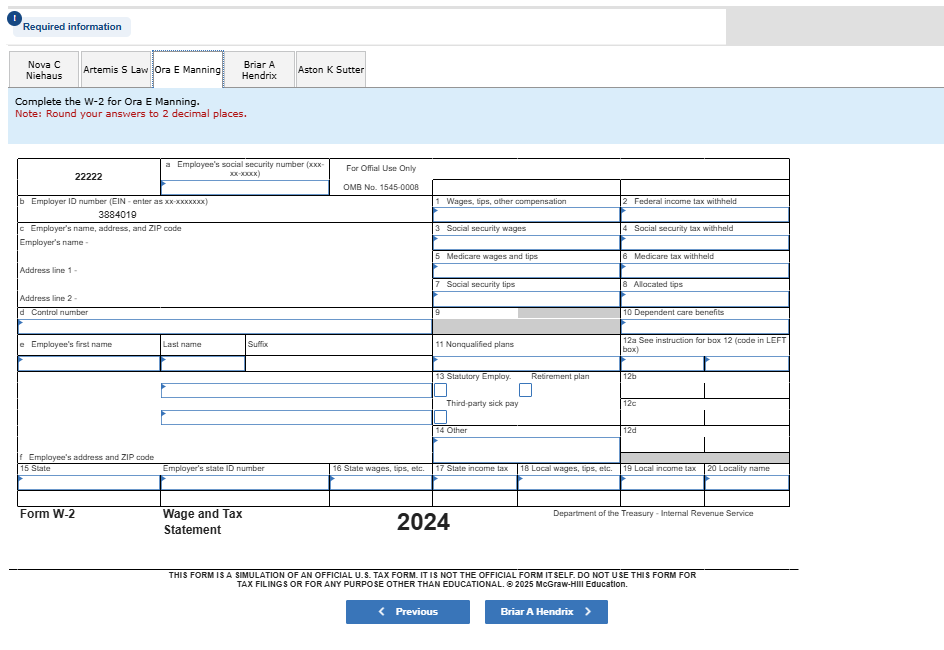

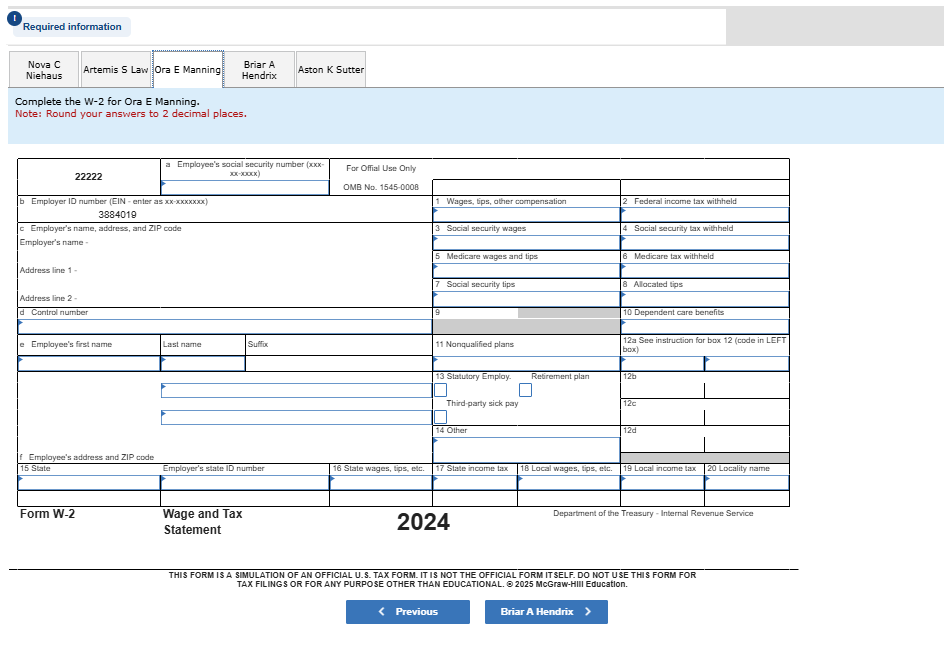

\ Required Information [The following information applies to the questions displayed below.] Leda. Incorporated is located at 433 Augusta Road, Caribou, Maine, 04736, phone number 207-555-1212. The Federal EIN is 54-3910394, and it has a Maine Revenue Services number of 3884019. Requlred: Owner Kieran Leda has asked you to prepare Form W-2 for each of the following employees of Leda, Incorporated as of December 31. 2024. The same deductions are allowed for state tax as they are for federal tax. Note: Instructions on format can be found on certaln cells within the forms. Required information Nova C Niehaus Artemis S Law Ora E Manning Briar A Hendrix Aston K Sutter Complete the W-2 for Ora E Manning. Note: Round your answers to 2 decimal places. \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline \multirow{2}{*}{22222} & \multicolumn{2}{|c|}{a Employee's social security number (xxx-30--000x)} & \multicolumn{5}{|c|}{For Offial Use Only} \\ \hline & & & & \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{2}{|c|}{\multirow{2}{*}{\begin{tabular}{l} b. Emplayer ID number (EIN - enter as xx-xxxxxxxx) \\ 3884019 \end{tabular}}} & & & \multicolumn{2}{|l|}{1 Wages, tips, other compensation} & \multicolumn{2}{|l|}{2 Federal income tax withheld} \\ \hline & & & & \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{4}{|l|}{\multirow[t]{6}{*}{\begin{tabular}{l} c Employer's name, address, and ZIP code \\ Employer's name - \end{tabular}}} & \multicolumn{2}{|l|}{3 Social security wages} & \multicolumn{2}{|l|}{4 Social security tax withheld} \\ \hline & & & & & & & \\ \hline & & & & \multicolumn{2}{|l|}{5 Medicare wages and tips} & \multicolumn{2}{|l|}{6 Medicare tax withheld} \\ \hline \multicolumn{4}{|l|}{\multirow{3}{*}{Address line 1 -}} & \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{} \\ \hline & & & & \multicolumn{2}{|l|}{7 Social security tips} & \multicolumn{2}{|l|}{8 Alocated tips} \\ \hline & & & & \multicolumn{2}{|c|}{} & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{4}{|l|}{d Control number} & 9 & & \multicolumn{2}{|l|}{10 Dependent care benefits} \\ \hline \multicolumn{4}{|c|}{} & & & & \\ \hline & Last name & \multicolumn{2}{|l|}{Suffix} & \multicolumn{2}{|l|}{11 Nonqualified plans} & \multicolumn{2}{|c|}{12a See instruction for box 12 (code in LEFT box)} \\ \hline & & & & & & & \\ \hline \multicolumn{4}{|l|}{\multirow[b]{5}{*}{\begin{tabular}{l} f Employee's address and ZIP code \\ f Employee's address and ZIP code \end{tabular}}} & \multirow[t]{2}{*}{\begin{tabular}{l} 13 Statutiory Employ. \( \square \) \\ Third-party sick pay \end{tabular}} & \multirow[t]{5}{*}{Retirement plan} & \multicolumn{2}{|l|}{12b} \\ \hline & & & & & & \multicolumn{2}{|l|}{12c} \\ \hline & & & & \multicolumn{2}{|l|}{\multirow[t]{3}{*}{14 Other}} & \multicolumn{2}{|l|}{12d} \\ \hline & & & & & & \multicolumn{2}{|c|}{} \\ \hline & & & & & & \multicolumn{2}{|c|}{} \\ \hline \multicolumn{3}{|l|}{15 State} & 16 State wages, tips, etc. & 17 State income tax & 18 Local wages, tips, etc. & 19 Local income