Home /

Expert Answers /

Accounting /

required-prepare-the-journal-entry-at-january-1-2024-to-record-the-change-in-accounting-princi-pa337

(Solved): Required: Prepare the journal entry at January 1, 2024, to record the change in accounting princi ...

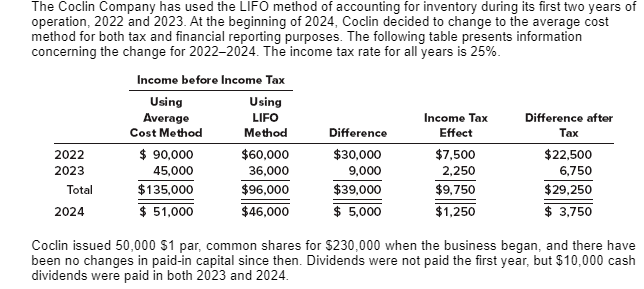

Required: Prepare the journal entry at January 1, 2024, to record the change in accounting principle. Prepare the 2024–2023 comparative income statements beginning with income before income taxes. Prepare the 2024–2023 comparative statements of shareholders’ equity. [Hint: The 2022 statements reported retained earnings of $45,000. This is $60,000 − ($60,000 \times 25%).]