Home /

Expert Answers /

Accounting /

requirements-h-journalize-and-post-closing-entries-at-december31st-2019-i-prepare-post-closin-pa913

(Solved): Requirements? h. Journalize and post-closing entries at December31st,2019. i. Prepare post-closin ...

Requirement’s?

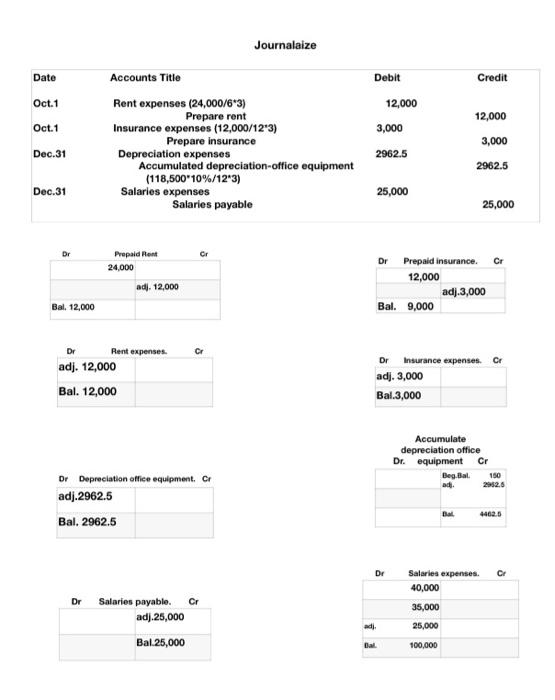

h. Journalize and post-closing entries at December31st,2019.

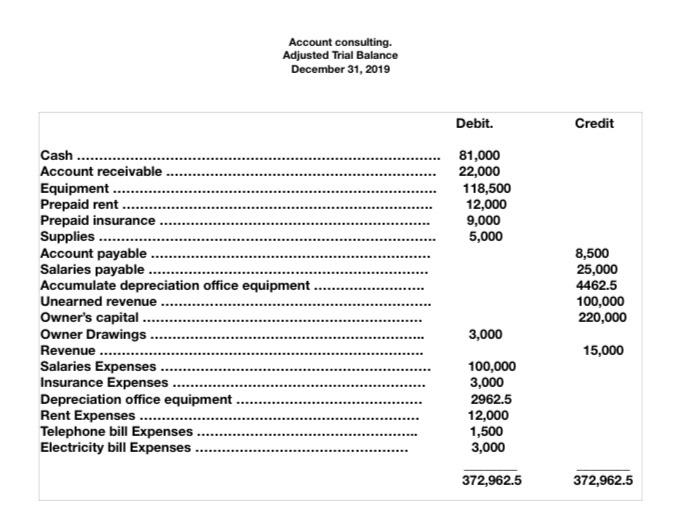

i. Prepare post-closing trail balance at December 31st, 2019.

Journalaize Debit Credit \begin{tabular}{rr} 12,000 & 12,000 \\ 3,000 & 3,000 \\ 2962.5 & 2962.5 \\ 25,000 & 25,000 \end{tabular} Dr Pent expenses. Cr adj. 12,000 Bal. 12,000 Dr Prepaid insurance. Cr \begin{tabular}{c} 12,000 \\ adj. 3,000 \end{tabular} Bal. 9,000 a Dr Depreciation office equipment. adj.2962.5 Bal. 2962.5 Accumulate depreciation office Dr. equipment ad]. 3,000 Bal.3,000 Dr Insurance expenses. Cr adj. 3,000 Bal.3,000 \begin{tabular}{|c|} \hline Dr Salaries payable. Cr \\ adj.25,000 \\ Bal.25,000 \end{tabular} \begin{tabular}{|ll|} \hline Dr Salaries expenses. Cr & Cr \\ & 40,000 \\ & 35,000 \\ & 25,000 \\ adj. & 100,000 \\ Dad. & \end{tabular}

Account consulting. Adjusted Trial Balance December 31, 2019