Home /

Expert Answers /

Finance /

resilient-ltd-is-considering-three-independent-investment-projects-with-equal-expected-market-liv-pa995

(Solved): Resilient Ltd is considering three independent investment projects with equal expected market liv ...

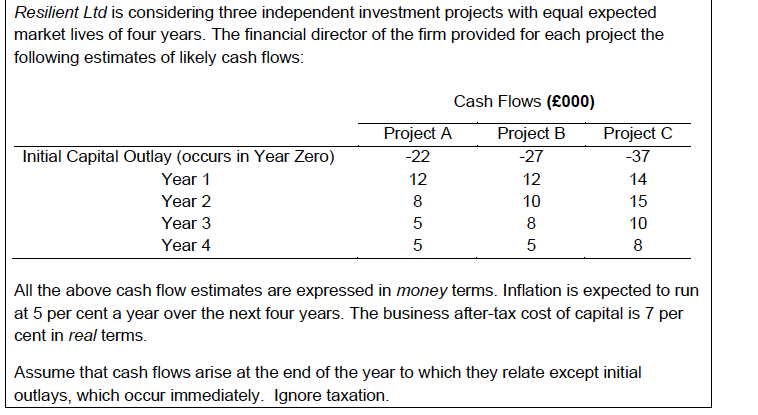

Resilient Ltd is considering three independent investment projects with equal expected market lives of four years. The financial director of the firm provided for each project the following estimates of likely cash flows: Initial Capital Outlay (occurs in Year Zero) Year 1 Year 2 Year 3 Year 4 Cash Flows (£000) Project A Project B Project C -22 -27 -37 12 12 14 8 10 15 5 8 10 5 5 8 All the above cash flow estimates are expressed in money terms. Inflation is expected to run at 5 per cent a year over the next four years. The business after-tax cost of capital is 7 per cent in real terms. Assume that cash flows arise at the end of the year to which they relate except initial outlays, which occur immediately. Ignore taxation.

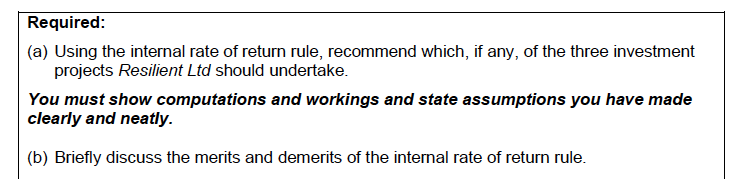

Required: (a) Using the internal rate of return rule, recommend which, if any, of the three investment projects Resilient Ltd should undertake. You must show computations and workings and state assumptions you have made clearly and neatly. (b) Briefly discuss the merits and demerits of the internal rate of return rule.

Expert Answer

a) Project A have higher Internal rate of return.so it should be